¿Y ahora qué…? Ayer se firmo la carta de salida de la UE…, con una libra devaluada y un porvenir que hay que escribir…

Moments ago, Theresa May signed the letter to European Council President Donald Truk which will invoke Article 50 and Trigger Brexit.

What happens next?

Here is a summary of next steps courtesy of Jack Davies, consultant editor of Trading Floor, courtesy of Saxo Group

+ The UK government triggers Article 50 starting the Brexit process Wednesday

+ Two years of negotiations to be set in motion to uncouple UK from EU

+ Sterling has plunged circa 15% since the night of the Brexit vote

+ Future of EU workers in the UK and visa-versa yet to be decided

The British government is set to formally invoke Article 50, the clause within the European Union’s de facto constitution that almost didn’t make it into the final draft because what it allows for – the exit of a member state from the EU – was thought by many too awful to be permitted.

But allowed it was and now what had been thought unthinkable is to happen Wednesday, a member state has begun what will undoubtedly be an excruciating divorce from the bloc.

How is Article 50 triggered and what happens next?

Triggering Article 50 is easy. In theory, it could be as simple as somebody in Whitehall sending an email to somebody in Brussels. In the end, the UK’s ambassador to the EU informed Donald Tusk that it would come in letter form to his office on March 29. But even as late as mid-March, eurocrats were still scratching their heads as to whether letter or email was more appropriate and if so who should be sending and receiving the memo.

But if they struggled with protocol, it doesn’t get much simpler from here. Under the Lisbon Treaty, member states wishing to leave the European Union have two years from the day they trigger Article 50 to negotiate their exit. In theory, if after 24 months a compromise has not been reached, then the state in question is dumped from all EU institutions and frameworks instantly and without any phasing out to cushion the fall.

Interdependency is hardcoded into the union, so this kind of cold-turkey exit is something both sides will be keen to avoid. If they are to do so, the bulk of the negotiations will have to have been concluded within 18 months of Article 50 being invoked, so as to allow enough time for both parliaments to approve the final deal.

The clock’s likely to run even tighter than that though, as the EU has said it won’t begin negotiating with Westminster until the UK settles a bill estimated to be as high as $64 billion.

What will happen to sterling when Article 50 is triggered?

Britain’s vote to leave the EU last summer trashed sterling, which lost 16 cents against the dollar overnight, and the pound has since plummeted to even lower depths. One slight consolation for sterling buyers will be that the pound will likely have little or no reaction to the invocation of Article 50, which has already been priced in by the market.

So much so in fact that many view the pound as undervalued, given the relative strength of the British economy, which is expected to grow by 2% over the coming year.

What happens to FTSE 100 after Article 50 is triggered?

Saxo Bank’s head of equities Peter Garnry says that while general volatility will increase “simply because of the noise”, the triggering of Article 50 should not have a major immediate impact on equity markets since the event has already been discounted by them.

That said, what comes next could hold another story. As Garnry points out, “triggering starts the noisy political negotiations which will be a recurrent theme over the next two years.”

The FTSE 100’s high concentration in financials, mining and export-driven consumer staples companies (such as BAT, Diageo, Unilever and RB) makes the index vulnerable “should the GBP go up again on improving sentiment or even worse in tandem with falling commodity prices,” Garnry warns.

What will happen to EU nationals in Britain and vice versa?

As we have pointed out before, the four million people most vulnerable in a showdown between Brussels and Number 10 are the EU nationals living in the UK and British citizens making their living on the continent.

The British parliament recently voted down a proposal to safeguard the presence of EU nationals already in Britain regardless of the outcome of the next two years’ negotiations.

While the proposal was motivated by the Kantian precept that person should be used as a means to an end (in this case a bargaining chip in the messiest international negotiations since the second world war), British MPs sided with the government, which argued that while it was in favour of allowing EU citizens to remain, it did not want to give that concession away unconditionally.

And so, with neither side having ruled out a “hard Brexit” (the UK government has announced it’s currently drawing up plans for the outcome), those four million people appear to be as vulnerable right now as they fear.

Saxo’s head of forex strategy John J Hardy recently told TradingFloor that due to reciprocal rights for EU and UK nationals being such a potent bargaining chip, we could be well into 2018 before negotiators arrive at any meaningful accord on the issue.

Finally, here is Saxo’s head of macro analysis Christopher Dembik, who summarizes the salient points in the following video. Here are the key points:

+“Brexit will have clearly a deep impact on the [British] market in the medium term,” says Saxo’s head of macro analysis Christopher Dembik, who is based in the Danish bank’s Paris office.

+“For the British economy, I am not positive. There is no reason to believe that Brexit would have [only] a slight impact on the economy.

+“Brexit would have a strong impact because it would block investments as soon as investors understand that the UK doesn’t have a strong strategy to negotiate and that the EU won’t make it easy for the UK to leave.”

+He does not expect much to happen in terms of significant negotiations between the UK and EU until after the German federal election in September. However, Dembik says that British prime minister

+Theresa May could surprise many and pull a snap election to gain greater support - something former PM Gordon Brown failed to do when he succeeded Tony Blair and later lost a general election to the Conservative Party’s David Cameron.

+“Theresa May will face probably many challenges in order to negotiate with the European Union,” adds Dembik.

+“I do believe she will have no other choice than for calling for an early election in order to have enough popular support to try to negotiate with the European Union.”

+Despite these issues, Dembit says that in the longer term, the “strong” UK “will succeed and have a bright future.”

Abrazos,

PD1: Pero no les importa tanto ya que no les ha ido mal y su socio de referencia, los EEUU, les van a ayudar…

PD2: Pero la industria británica ya no es lo que era…

Están algo fuera de juego:

PD3: Y su saldo comercial con Europa es muy negativo…, les va a doler.

Sus expectativas de crecimiento son pobres:

PD5: Aunque su banco central, el Banco de Inglaterra (BoE), no ha hecho tantos disparates como los otros:

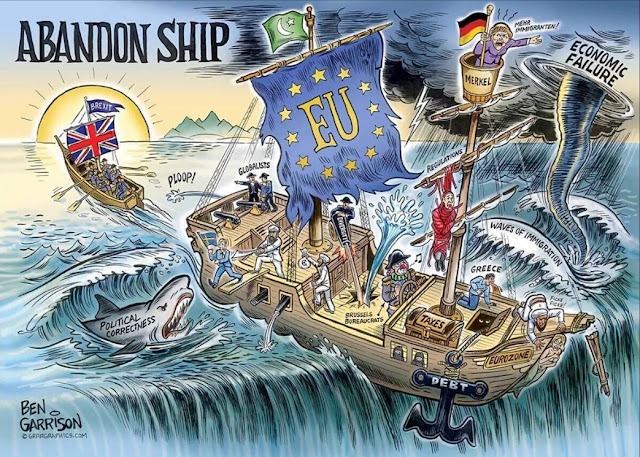

PD6: No será que los piratas británicos han visto el futuro mejor que los demás…

Sí, es una viñeta, pero ¿estamos así?

PD7: "Si ríes, yo reiré contigo; pero si lloras, yo haré que sonrías junto a mi." Esta es la mejor forma de comportarse con tu mujer…