Según el Wall Street Journal, la situación de los bancos españolas es complicada todavía:

Spanish Bad-Debt Data Tell Divergent Stories

Nonperforming Loans Are Falling; Analysts Point to Broader Measure

MADRID—Spanish banks say a modest decline in bad loans in recent months marks a postcrisis turning point. But analysts warn that a more-comprehensive measure of the banks' health points to a longer road to recovery for lenders.

After a vicious real-estate bust and a deep recession, Spanish banks' nonperforming loans—cases in which borrowers have fallen behind or defaulted on payments—have edged down to 13.4% of total loans as of April from a record-high 13.6% in December, according to Spain's central bank.

But some analysts say investors should be looking at the banks' nonperforming assets, a broader metric that includes repossessed real-estate assets and some restructured loans, including those transferred to Spain's "bad bank" entity.

At the end of the first quarter, those nonperforming assets totaled €€372 billion ($506 billion), meaning bad debts are around 22% of lenders' total loans, according to ExaneBNP Paribas BNP.FR +1.40% analyst Santiago López Díaz.

"It seems we are close to (or even past) the peak of officially reported nonperforming loan figures, but not everything that glitters is gold," Mr. López Díaz wrote recently. "Reported nonperforming loans clearly understate the order of magnitude of the credit-quality disaster."

Nonperforming assets are a better measure of banks' health, some analysts say, because the metric shows the full extent of bad debts the lenders have to work through and provides a more realistic picture of the continued drag on earnings that banks face. It captures foreclosed homes a bank will have to try to sell and repeatedly refinanced loans to property developers or other businesses that are unlikely to be paid.

Fears about the health of Southern European banks have largely eased over the past year. But they rushed back into the spotlight last week when worries about Banco Espírito Santo, BES.LB -5.50% one of Portugal's biggest lenders, sparked a market selloff across the continent.

Spanish banks have been among the biggest beneficiaries of the returning market confidence. Shares of the four largest Spanish banks whose main business is in the country have risen an average of 17.8% since the beginning of the year, compared to a 2.5% decline in the Stoxx European banks index, as investors cheer Spain's nascent economic recovery.

But the debate over whether Spanish banks are providing investors with a helpful snapshot of their health is a sign of the lingering fears about what lurks on European bank balance sheets.

Spanish banks routinely disclose their nonperforming loans, but they don't provide detailed quarterly figures for nonperforming assets.

The information that banks report each quarter is often insufficient to determine the total volume of bad assets, says Alberto Postigo, a Moody's Investors Service analyst in Madrid.

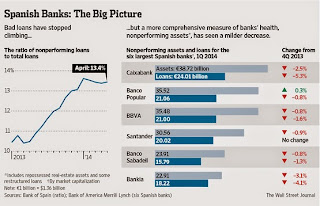

Nonperforming loans at the six largest Spanish banks fell or were flat in the first quarter of this year compared with the fourth quarter of 2013. But nonperforming assets at four of those banks— Caixabank SA, CABK.MC +0.09% Banco de Sabadell SA,SAB.MC -0.30% Bankia SA BKIA.MC -1.27% and Banco Bilbao Vizcaya Argentaria SABBVA.MC -0.42% —declined less quickly, and actually increased at Banco Popular Español SA, POP.MC -0.28% according to Sergio Gamez, a Bank of AmericaBAC -0.39% Merrill Lynch analyst.

Mr. Gamez estimates that Spanish banks' total nonperforming assets are equivalent to €433 billion, or 40% of the Spanish economy.

Caixabank, for instance, recorded a 5.3% fall in nonperforming-loan volume from the fourth quarter of 2013 to the first quarter of this year, but only a 2.5% drop in nonperforming assets, according to Mr. Gamez.

Banco Santander SA SAN.MC +0.13% was the exception. The lender reported no change in its nonperforming loans quarter over quarter and a 0.9% decrease in nonperforming assets in its Spanish unit, according to Mr. Gamez.

Representatives for Caixabank, Sabadell, Bankia and Santander declined to comment. A BBVA spokeswoman says nonperforming loans are a better way to measure future trends in asset quality because they are a "leading indicator" of loan defaults.

A Banco Popular spokesman says he disagrees with the Bank of America analysis. The bank's nonperforming loans and assets both fell, he says.

One potential explanation for the discrepancy between nonperforming loans and assets: Banks could be accelerating foreclosures, analysts suggest. Foreclosing on a home would move an overdue mortgage loan from the nonperforming-loans bucket into the one for nonperforming assets.

Indeed, an analysis by Mr. Gamez shows that the six largest Spanish banks increased the number of foreclosures by an average 2.2% from the fourth quarter of 2013 to the first quarter of this year.

Banks are likely to have to step up what they disclose, and how often, when the European Central Bank takes over in November as the regulator for the euro zone's largest banks, says Robert Tornabell, a professor of banking at ESADE Business School in Barcelona.

An ECB spokeswoman says that every quarter, banks will have to disclose their "nonperforming exposures," which includes loans and other credit risks, although that change won't take effect in November. The majority of banks will have to disclose foreclosures and repossessions "regularly," she added.

For now, Spanish banks continue to highlight their nonperforming loans.

Banco Popular Chairman Ángel Ron touted the first-quarter improvement in the bank's nonperforming-loan volume during a June conference in the northern Spanish city of Santander, titled "Europe Leaves the Crisis Behind."

"Based on the internal numbers that we have at the bank, we would anticipate that we are going to see an improvement in bad loans in upcoming quarters as well," Mr. Ron said. "This is very good news."

But Banco Popular's nonperforming assets actually grew 0.3% from the fourth quarter to the first quarter, according to Mr. Gamez. The Banco Popular spokesman disagrees. He says the bank´s nonperforming assets fell 0.9%

Abrazos,

PD1: ¿Son los bancos tan grandes? Los chinos sí, pero los otros no tanto…

Hoy traigo un gráfico de The Economist sobre cómo a ido cambiando a través de los años, la nacionalidad de los bancos principales (de mayor tamaño) en el mundo, seguido de un estudio del FMI sobre los mayores bancos del mundo.

A decade ago, Europe counted five banks among the world's top ten. Today there is only one, HSBC. During that time Chinese banks not only made the list, but vaulted into the top two places, according to annual rankings by The Banker released on June 30th. Last year China Construction Bank shoved aside America's JPMorgan Chase to become second largest in terms of tier-one capital. ICBC (formerly known as Industrial and Commercial Bank of China) kept the top spot; with more than $200 billion, it is also the world's most profitable bank. Though Japan's Mitsubishi UFJ Financial Group is close to leaving the list altogether, until 2007 its $117 billion heft would have made it the world's biggest bank. Despite regulations designed to keep banks' ambitions modest so that none are too big to fail, today's groups are larger than ever. Global banking profits are at a record high of $920 billion—a third from Chinese banks alone.

Una pregunta que nos hacemos a menudo: ¿Son los bancos tan grandes? (Are Banks Too Large? Maybe, Maybe Not) un estudio de Luc Laeven, Lev Ratnovski, and Hui Tong.

Es un estudio de sección cruzada de grandes bancos en 52 países, y se encontró que los mayores bancos suponene en realidad un mayor riesgo sistemico, más no a nivel individual. A continuación, se presenta el resumen de los resultados a través de una serie de figuras: La Figura 1 muestra cómo el tamaño del balance de los bancos más grandes del mundo aumentó de dos a cuatro veces en los 10 años anteriores a la crisis. La Figura 2 ilustra cómo los bancos pasaron de los préstamos tradicionales hacia actividades orientadas a los mercados de valores. Además, los grandes bancos parecen tener un modelo de negocio diferenciado arriesgado. Tienden a tener al mismo tiempo un bajo capital (Figura 3), una financiación menos estable (Figura 4), más actividades basadas en los mercados (Figura 5), y ser más organizativamente complejos que los bancos más pequeños (Figura 6).

PD2: Los bancos españoles siguen dependiendo del dinero del Banco Central Europeo:

PD3: Estos son los bancos que más han crecido en el último año en captación de clientes:

PD4: Los retornos de los bancos, por las bajadas de los tipos de interés, son cada vez menores:

PD5: Y la mora de los bancos españoles sigue ahí:

PD6: El año que viene saldremos de la crisis:

2009

2010

2011

2012

2013

2014

¿No te suena siempre lo mismo? Mira:

PD7: Este verano voy a hacer una oración continua muy sencilla: "¡Te pido por los malos, para que se hagan buenos; y por los buenos, para que sean simpáticos!"