Hay dudas de que el bosque no nos deje ver las ramas… Aquí tienes una rama:

I have written extensively about the data behind the headline media reports. I have also discussed the importance of the relationship between the underlying data trends relative to broader macroeconomic perspectives. However, it is sometimes helpful just to view the various economic indicators and draw your own conclusions outside of someone else's opinion.

With the economy now more than 6-years into an expansion, which is long by historical standards, the question for you to answer by looking at the charts below is:

"Are we closer to an economic recession or a continued expansion?"

How you answer that question should have a significant impact on your investment outlook as financial markets tend to lose roughly 30% on average during recessionary periods. However, with margin debt at record levels, earnings deteriorating and China struggling with a sinking economy, this is hardly a normal market environment within which we are currently invested.

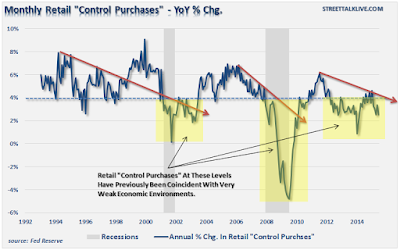

Therefore, I present a series of charts which view the overall economy from the same perspective utilizing an annualized rate of change. In some cases, where the data is extremely volatile, I have used a 3-month average to expose the underlying data trend. Any other special data adjustments are noted as well.

Leading Economic Indicators

Durable Goods

Investment

ISM Composite Index

Employment & Industrial Production

To understand more about the difference between the BLS employment report with and without the Birth/Death adjustment read this.

Retail Sales

Social Welfare

The Broad View

Economic Composite

(Note: The Economic Composite is a weighted index of multiple economic survey and indicators - read more about this indicator)

If you are expecting an economic recovery, and a continuation of the bull market, then the economic data must begin to improve markedly in the months ahead. The problem has been that each bounce in the economic data has failed within the context of a declining trend. This is not a good thing and is why we continue to witness an erosion in the growth rates of corporate earnings and profitability. Eventually, that erosion combined, with excessive valuations, will weigh on the financial markets which is potentially much of what we are witnessing now.

For the Federal Reserve, these charts make the case that continued monetary interventions are not healing the economy, but rather just keeping it afloat by dragging forward future consumption. The problem is that it leaves a void in the future that must be continually filled.

The question on everyone's mind is whether the economy is strong enough to withstand rate hikes by the Federal Reserve? In my opinion, the answer is no. The economy continues to ebb and flow between weak growth and no growth. This puts the Federal Reserve at risk of a policy mistake that could trip the economy into an outright recession. While there have certainly been positive bumps in the data, as pent-up demand is released back into the economy, the inability to sustain growth is most concerning.

But then again, that is just what I see.

Abrazos,

PD1: Hay un cierto cambio de las cosas que se compran en EEUU…

How much are American consumers spending? Not nearly as much as history would suggest – but much more than news headlines express. According to the Census Bureau, retail sales grew only 2.4% over the past year. That’s less than half the 5% pace set in the 2002–2007 expansion. And the trend suggests that the post-crisis surge was a temporary, unsustainable rebound. Isn’t this at odds with the view that the U.S. consumer is a source of strength?

The release of retail sales data can move markets, and its month-to-month volatility can be a headache. Consider Bloomberg’s July headline, “Drop in U.S. Sales Dashes Optimism for a Stronger Second Quarter,” followed by August’s “Retail Sales Rise as American Consumers Unbowed by Global Events.” The indicator’s intrinsic volatility makes it important to examine the report’s components when looking for investable ideas.

The first thing to note is that retail sales data are not adjusted for inflation – or deflation. When the price of an item falls, it appears as if people are buying less when in reality they may just be paying less. With the 57% plunge in the price of West Texas Intermediate crude oil over the past year, for instance, consumers are spending a lot less on gasoline – even as demand has risen. Removing gasoline sales from overall retail sales data yields a healthier picture.

Let’s consider in absolute terms how much Americans aren’t spending on gas anymore, and where those savings may be going. Last year Americans consumed 137 billion gallons of gas, according to the U.S. Energy Information Administration. With the national average price of a gallon of gas falling from $3.54 to $2.73 over the past year, there’s an extra $111 billion to spend! Given the savings on gasoline, the most obvious thing consumers are buying is cars. Indeed, vehicle sales have grown at an annualized pace of 8.0% so far this year – on track for 17.8 million units, which would be the most in nearly a decade. The gradual labor market recovery, strong consumer sentiment and still low interest rates are feeding through to other areas as well:

Sectors of Opportunity

Looking through the retail sales data more closely, we see investment opportunities across many sectors. Following the recent upswing in housing, we have also seen pent-up demand for remodeling, which we expect will fuel future spending on home improvement and furnishings. We are also seeing a secular turn away from mall-based department stores. In the early 1990s, online and mail-order retail sales were less than a third of department store spending – but they now total more than 70% of what traditional department stores bring in, the Census Bureau reports. And that anti-mall sentiment is showing up in a preference for spending on services – including restaurants and lodging – as well as sporting goods and hobbies.

In sum, Americans are pocketing some of their savings at the pump, but they’re also spending more on cars, restaurants, home improvements and lodging. Identifying the highest growth sectors in the economy – and the strongest companies within them – is the key to identifying investments with the best potential.

PD2: Y la bolsa, ¿está cara o barata?

Here's a quick look at equity valuations using some traditional and non-traditional methods. Data as of August 31, 2015. Worst case, stocks look a bit overvalued. Best case, stocks still look attractive.

According to Bloomberg's calculations, the trailing 12-month PE ratio of the S&P 500 (17.4) is only slightly above its long-term average (16), and far lower than its 2000 peak of 30. My read of this is that equity valuations are about average—neither over- nor under-valued.

The chart above compares the earnings yield on the S&P 500 (the inverse of the PE ratio) to the yield on BAA corporate bonds. On this basis, holding stocks gives you a slightly better yield than holding the typical corporate bond. From an historical perspective, what this means is that stocks are unusually attractive relative to corporate bonds. Why? Because equity ownership gives you unlimited, long-term upside potential, whereas the best you can get from holding corporate bonds is their yield to maturity. It also implies that the equity market is still possessed of a healthy degree of pessimism. Why? Because if investors were optimistic about the prospects for corporate earnings they would much prefer to own equities than corporate bonds, since equities promise not only yields but capital gains.

The chart above compares the earnings yield on stocks to the inverse of the real yield on 5-yr TIPS. These two series tend to move together, and they are good proxies for the degree of pessimism/optimism in equity prices. For example: when optimism was high in 2000, real yields were very high (meaning TIPS prices were very low) and earnings yields were very low (meaning equity prices were very high). The world was so enthusiastic about the prospect for corporate earnings and economic growth that investors were willing to all but ignore the historically attractive and government-guaranteed 4% real yields on TIPS, in favor of the non-guaranteed 3.5% earnings yield on stocks. Today, investors seem indifferent to the almost 6% yield on stocks, versus the meager 0.3% real yield on 5-yr TIPS. Pessimism is not hard to find these days.

Investors always have a choice between owning risky stocks or risk-free 10-yr Treasuries. Currently, the earnings yield on stocks is about 350 bps higher than the yield on 10-yr Treasuries. From an historical perspective, this is a relatively rare occurence. My read on this is that investors today are not very confident that corporate profits can hold at current levels. They fear that earnings are going to decline, and so they demand an unusually high premium for holding stocks instead of Treasuries. By this measure, stocks offer attractive valuations for those who believe that earnings are unlikely to fall.

Corporate profits tend to track the growth of nominal GDP over time. Stock prices are theoretically driven by the discounted present value of future after-tax earnings. The market cap of equities (using the S&P 500 as a proxy) should therefore tend to track the inverse of risk-free Treasury yields (because they are the appropriate discount rate). And as the chart above shows, they do. Treasury yields are very low from an historical perspective, but the market cap of equities is not out of line with historical trends, being roughly the same today as in the early 1960s.

PD3: Seréis como dioses, es lo que le dijo la serpiente a Adán y Eva. Tendréis todo el poder, mandaréis sobre todas las cosas, dominaréis la creación… Es el éxtasis de la soberbia. Qué poco lejos anda alguno en estos días… La erótica del poder, el dominarlo todo, el mandar a todos…, el yo, me, mi, conmigo…

Y frente a esto, el Señor dijo que nos hiciéramos como niños, que nos hiciéramos humildes, que nos simplificáramos, que no pensáramos mal de los demás, que no les critiquemos, que no les envidiemos, que seamos tan puros como son los niños, que queramos como quieren los niños, de verdad, sin esperar nada a cambio…