Este año no pensaba poner ninguna, ya que siempre se equivocan, pero os suelto solo una:

There’s a lot to be worried about going into 2017 both in terms of financial markets and in terms of geopolitical concerns.

Globaly, SocGen's latest quarterly "Swan Risk" chart points out that China is the big "'pure' economics" risk in the G5, with the "most significant risks with pockets of significant excess in housing, high debt levels and a burgeoning NPL problem," and thus they see the risk of a hard landing at 20%. Taking it one step further, they added that "insufficient" structural reform "leaves the economy at very significant risk of a lost decade, which we set at a 40% probability."

Broader political risk remains a major threat, conjoining the numerous upcoming European elections, potential spillover from policy uncertainty in the EU, and "significant uncertainty" regarding future US policy (with Europe the most concerning).

Finally they argues that bond yields are the "Achilles' heel of global markets," pointing out that "market pricing on Fed rate hikes, however, remains modest and there is to our minds significant risk of a more disorderly repricing of global bond yields. Such a scenario could have very negative spillover, not least to emerging markets."

First, as Goldman warns, while investors have been focusing on the prospect of a lower statutory corporate tax rate, the firm's US economist Alec Phillips notes that it will likely come with provisions that will offset much of the benefit of a lower rate. For instance, under the House Republican plan, several corporate tax incentives, such as the interest expense deduction, would be repealed. Furthermore, the plan proposes a redefinition of foreign and domestic income based on where sales, rather than production, occurs. Furthermore, under Mr. Trump’s plan, the deficit as a percentage of GDP would jump from 3.2% in 2016 to 5.0% in 2017 and 6.1% in 2018. The annual deficit will rise from a projected $590 billion in 2016 to $960 billion in 2017 and $1.2 trillion in 2018. Our US economics team has a more restrained baseline forecast that projects the deficit as a percentage of GDP will be 3.4% in 2017 and 4.0% in 2018 while the deficit will total $650 billion in 2017 and $800 billion in 2018.

Second, another key risk of President-elect Trump’s proposed economic policies is higher inflation. Realized measures of inflation have steadily risen in recent months. Core CPI now stands at 2.2% while core PCE, the Fed’s preferred inflation metric, has risen to 1.7% from 1.3% last year (see Exhibit 24). At the same time, reduced labor market slack has supported wage growth and our GS Wage Tracker stands at 2.6%, its highest level post-crisis (see Exhibit 25).

Third, the bond market has started to price in a macroeconomic landscape of higher inflation and interest rates. Ten-year forward inflation expectations rose by 20 bps to 1.9% in just two weeks following the election (see Exhibit 26). Higher expected inflation has pushed 10-year nominal interest rates to 2.3%, an increase of 50 bp in just a few weeks. Looking forward, Goldman's Economics team and the market expect bond yields will rise in 2017. Additionally, Goldman expects the short end and long end of the yield curve will rise faster than currently priced by the market (see Exhibit 27). In other words, the Fed is now behind the curve, pardon the pun.

Fourth, with the 10Y yield coming just shy of 2.50% on Thursday, financial conditions as dictated by the bond market are tight enough to start pressuring stocks. Recall that as Goldman also explained last week, "a rise in US bond yields above 2.75% would create a more serious problem for equity markets: at that point we would expect the correlation between bonds and equities to be more positive - i.e., any further rises in yields from there would be a negative for stock returns."

Fifth, as inflation expectations and yields rise, Goldman expects higher realized inflation and interest rates will restrict any S&P 500 valuation expansion during 2H 2017. The S&P 500 forward P/E has already increased by 71% since September 2011, growth surpassed only by the 1987 cycle (112%) and the Tech Bubble (115%). Historical P/E expansion cycles are usually accompanied by falling interest rates and falling inflation while Goldman now projects both bond yields and inflation will rise during the next several years (see Exhibit 28). Although the S&P 500 trades at roughly fair value relative to history given core CPI of 2.2%, higher inflation is typically associated with a lower forward P/E multiple (see Exhibit 29).

Sixth, higher bond yields are usually associated with a lower forward P/E multiple. Since 1976, the average forward P/E multiple when the 10-year US Treasury ranges between 2% and 3% is 14.2x. However, the S&P 500 currently trades at 17.1x forward bottom-up consensus EPS and we expect some downside risk to the multiple as bond yields continue to rise during 2017.

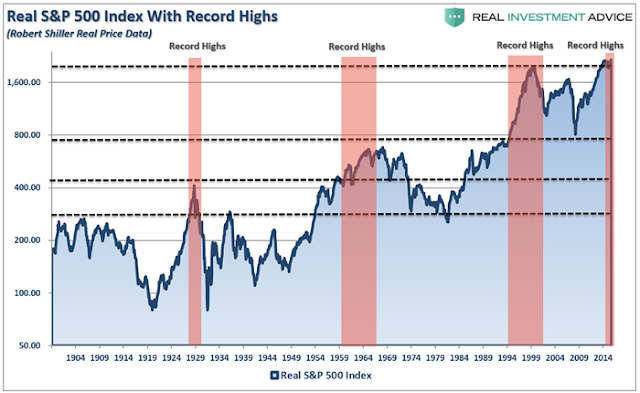

Seventh, and last, despite Goldman's recent bout of euphoric optimism, predicated only by the outcome of a presidential election which, as Goldman itself said, is very much unclear, the firm clearly admits that, and we quote, "S&P 500 valuation is stretched relative to history on nearly every fundamental metric. At the aggregate level, the S&P 500 index trades at the 85th percentile of historical valuation relative to the past 40 years. For portfolio managers, the more important fact is that the median S&P 500 company trades at the 98th percentile of historical valuation (see Exhibit 33)."

... So you're saying there is a 2% chance?

Abrazos,

PD1: This is the top…

Verás que los agoreros siempre se equivocan… Hay correcciones, pero son para seguir subiendo después…

PD2: Propósitos de Año Nuevo:

Época de buenos deseos

Sí, la Navidad es época de buenos deseos. Pero también tenemos la experiencia de que los buenos deseos de la Navidad rara vez duran más allá de las primeras semanas de enero. Supongo que esto se debe a la falta de virtudes. Una virtud tiene un componente digamos intelectual, otro emocional y otro volitivo.

El aspecto intelectual nos dice por qué hemos de hacer algo: por qué he de ser leal, sincero, humilde… por qué he de perder peso, ser más ordenado, vivir mejor la puntualidad… sonreír más frecuentemente, interesarme por las cosas de los demás… Ese conocimiento nos ayudará a tomar una buena decisión: si no sabemos por qué la tomamos, o no estamos convencidos de que eso es bueno, el propósito no durará mucho.

El emocional sirve de espoleta, de detonador. Ver el sufrimiento de un niño nos llama a la generosidad; sentir la vergüenza de que nuestros amigos vean el desorden de nuestra oficina nos animará a ordenarla. Pero lo más probable es que ese empujón dure poco. Si es de una sola vez, porque no nos acordamos más; si es muy frecuente, porque nos aburre o nos endurecemos o perdemos sensibilidad. Habitualmente, el subidón emocional tiene que traducirse inmediatamente en una reflexión y estudio y, muy muy pronto, en una decisión. Por eso los que venden por internet o por televisión te dicen que compres ahora, o que llames ahora. Pero a ellos les preocupa poco la continuidad: y eso pertenece a la tercera dimensión.

Porque la clave está en la dimensión volitiva: debo hacer tal cosa, y estoy decidido a hacerlo, y a hacerlo ya, poniendo toda la carne en el asador. Hay trucos que nos pueden servir. Uno es el examen frecuente. Otro, pedir la ayuda de alguien que nos exija o nos controle (antiguamente la gente ahorraba durante el año para tener dinero para las compras de Navidad, y lo hacía ingresando el dinero en alguna institución, con el encargo explícito de no devolver el dinero antes de, digamos, el 15 de diciembre). Es muy bueno fijarse metas pequeñas, muy concretas y a muy corto plazo. ¿Quieres ser más amable? Vete ahora a la oficina de al lado y pregunta a quien está allí cómo está, qué va a hacer en estas Navidades, si todos están bien en casa, etc. Y luego ponte otro objetivo para dentro de un rato, cuando llegues a casa; y para más tarde, cuando tengas tiempo para llamar a tu primo con quien no te llevas bien… ¡Ah!, y como esto no durará mucho, vuelve a empezar. Otra vez. Sí, ya sé que has fracasado en los últimos veinte intentos, pero vuelve a empezar. Porque -y aquí está la clave- has de adquirir el hábito operativo de lo que sea: ser amable, bajar peso, sonreír siempre…

Y, si eres creyente, reza por esa intención. Esto tiene tres objetivos. Uno, ganarte la cooperación de alguien más, Dios en este caso, que te ayudará. Y otro, convencerte tú de que no estás solo, o sea, de que tienes esa ayuda externa, y la tienes aunque no la notes, aunque se retrase… Y también para implicar a otros, cuando, por ejemplo, pides ayuda a Dios para ser tú más ordenado, pero también para que tus hijos sean más ordenados, de modo que tú debes luchar porque quieres ser ordenado y también porque quieres que tus hijos sean más ordenados y, claro, no los puedes dejar solos, no puedes fallarles. O sea que… a luchar, porque ahora ya no lo haces solo por ti, sino, sobre todo, por ellos.

Sí, la Navidad es una época de buenos deseos. Pero algunos son eficaces y otros no. Es ley de vida. Lo importante es que no te desanimes. Porque, ya te lo digo ahora, te morirás desordenado, mal carado, impuntual o lo que sea, pero te morirás feliz, porque habrás pasado unos cuantos años de tu vida intentando ser mejor. Y, a diferencia de las olimpiadas humanas, el premio -la felicidad en esta tierra, y luego en la otra- no se promete al que siempre triunfa, sino al que sigue intentándolo hasta un rato antes de morir. ¿No te lo crees? Bueno, haz la prueba, y cuando llegues a la otra vida ya me contarás tu experiencia. La felicidad no es una hoja de servicios intachable y, por tanto, imposible, sino la humildad de volver a intentarlo cada día. Y esto está al alcance de todos.

En la Navidad los cristianos recordamos el nacimiento de un Niño, que era -que es- Dios. Lo que él nos trajo no es la promesa del éxito, sino la seguridad de que, si lo intentamos una vez y otra, al final lo conseguiremos. Y, entre tanto, nos habremos hecho mejores, porque -y esto forma parte del mensaje que nos dejó aquel Niño- nos hacemos mejores cuando tratamos de hacer mejores a los demás.