Cuando las cosas se tuercen se tuercen. Cuando algo puede ir mal, va a ir mal… Son cosas que no fallan, es la vida misma… En los mercados, tenía que pasar. Pero ojo, no todo es lo mismo. Diferencia entre unos sitios y otros. Hay mucha liquidez dispuesta a entrar. Y la corrección puede durar cuatro días. Yo no la jugaría so pretexto de que cuando quieras vender ya habrá caído un cacho, y cuando te des cuenta de que tienes que comprar, porque se ha dado la vuelta y está subiendo ya, tu seguirás a por uvas y recomprarás más caro que cuando vendiste… Al menos es lo que me pasa a mi.

What goes up, eventually comes down.

That is just reality.

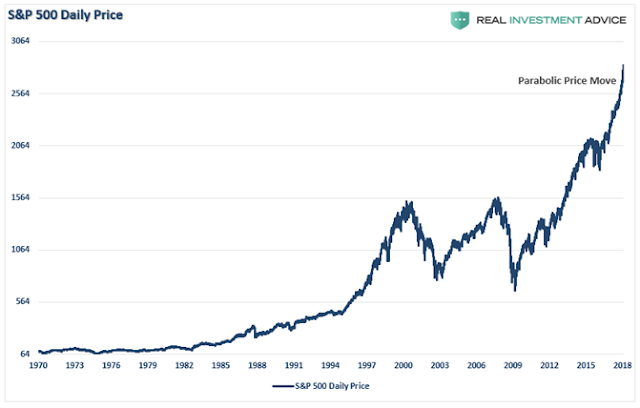

The bull market that began in 2009, has now entered the final stage of “capitulation” as investors throw caution to the wind and charge headlong into the markets with reckless regard for the consequences.

Of course, it isn’t surprising given the massive amounts of liquidity continually injected into the financial markets and global Central Banks have now figured out that continually rising financial markets solve much of the world’s ills. Simply, with enough liquidity, you can cover up bad (credit risks) by guaranteeing holders they will never default.

It’s genius. It’s a “no lose” investment scheme.

Unfortunately, we have seen this repeatedly in the past.

In the 1980’s it was “Portfolio Insurance” – a “no lose” investment program that eventually erupted into the crash of 1987. But not before the market went into a parabolic advance first.

In the 1990’s – it was the dot.com phenomenon which was “obviously” a “no lose”proposition. Even after Alan Greenspan spoke of “irrational exuberance,” two years later the market went parabolic once again.

Then in 2006-2007, banks invented the CDO-squared, a collateralized derivative obligation based on other collateralized derivative obligations. It was a genius way to invest with “no risk” because the real estate market had never crashed in history.

Today, it is once again an absolute “certainty” that markets will rise from here as global Central Banks have it all under control.

What possibly could go wrong?

Abrazos,

PD1: Llevo muchas semanas contándote que la gran subida parabólica es culpa de los FAANG y del efecto “de moda” que se ha impuesto en los mercados… Unos cuantos datos para que lo pilles:

El 63,8% de los últimos 1000 puntos de subida del Nasdaq se debe a estos 5 valores:

Netflix contribuye con otros 50 puntos (Es máa pequeña,pero sube más en el período)

Suman cerca del 75% de subida entre las seis…

PD2: Y hay otras 4 grandes corporaciones estadounidenses que están dejando mancas a las FAANGs:

The Fantastic Four That Make FANG Look Tame

The FANG stocks (Facebook, Amazon, Netflix and Google, now known as Alphabet) have become the face of the current bull market in equities. But there is another fantastic foursome, typically the province of far less intrepid investors, that has outperformed even this notable group over the past two years and more accurately epitomizes what has been behind the current blowoff.

These are: McDonald’s, Caterpillar, Boeing and 3M.

Looking at the valuation history of MCBM over the past twenty years, it’s clear that as a group they traded within a range of 1.5-to-2.5 times enterprise value-to-revenues. This period includes both the dotcom mania and the housing bubble. Then, in 2016 they broke out of this range and today they trade at more than twice their average valuation of the past two decades.

You might rationally presume that, because the stock market is known as a discounting mechanism, this surge to unprecedented valuations reflects a surge in their respective businesses. In that case, you would presume wrong. The average revenue growth for these four companies over the past five years has done just the opposite.

Put these two charts together and you get a result that is almost inexplicable. How can valuations scream to highs never seen before even as revenue growth stagnates or even goes negative?

The answer is twofold: stock buybacks and an epic reach for yield on the part of investors. These popular “blue chip” stocks have become “one decision” stocks like the “Nifty Fifty” were back in the late-1960’s and early 1970’s, for both investors and for their top executives.

It’s probably not that investors are buying them directly as “one decision” stocks but that dividend-focused ETFs have become the new “one decision” stocks. 32 ETFs count McDonald’s among their top 15 holdings. 25 ETFs count Caterpillar among their top 15. 83 ETFs overweight Boeing to this degree and 44 overweight 3M. They also count themselves among the top 10 holdings in the Dow Jones Industrial Average despite the fact that none of these four stocks can be found among the top 20 within the S&P 500.

How many investors in these “one decision” ETFs would be willing to buy these shares directly after understanding that means paying the highest valuation in history for the worst revenue growth? At least the top brass at the company can ensure they will get their bonus stock awards via buyback programs… and ensure they have someone to sell them to. Investors reaching for yield in these things today can hardly say the same.

PD3: Te digo que lo que ha subido era lo que estaba de moda. En bolsa solo sube lo que anda de moda, no todo lo demás… Mira cosas que ni se han enterado: las UTILITIES (las eléctricas, telecos y similares)

Y sin embargo, los bancos americanos sí que se desmadraron. Los analistas recomiendan con vehemencia los europeos, algunos no se han enterado, como el Deutsche Bank:

Pero es que la realidad de la banca europea es otra, nada tiene que ver, y en las bajadas, será lo que tire para abajo del mercado español…

Por último, Apple, que ha ido como un cohete, tuvo un fuerte revés en 2014-2015. Unos dicen que se va a repetir la historia. Por cierto, Apple es de las que están de moda y forma las FAANG…

PD4: San Agustín nos dice: “Ama y haz lo que quieras”. ¿Lo hemos entendido bien, o todavía la obsesión por aquello que es secundario ahoga el amor que hay que poner en todo lo que hacemos? Trabajar, perdonar, corregir, ir a misa los domingos, cuidar a los enfermos, cumplir los mandamientos..., ¿lo hacemos porque toca, o por amor a Dios? Si amáramos más no tendríamos límites, haríamos maravillas…