La política expansiva monetaria, los QE, consisten en echar dinero al sistema. Se habló hace poco que una alternativa sería tirar billetes desde un helicóptero para que lo cogiera la gente y consumiera más. Pero no, se prefirió hacer a través de los bancos a los que se les daba dinero para que estos concedieran más créditos y estimularan el crecimiento económico. Y esto no se hizo, ya que los bancos lo han estado usando para sanearse, fundamentalmente, para dejar los rendimientos de los bonos en negativo…

Es un despropósito total. Se junta una deuda pública acumulada del 240% sobre el PIB y unos activos en manos del Banco de Japón de casi el 100%, sin que aparezca la inflación ni se mueva su divisa…

Ya sólo les queda imprimir y echar los billetes por las calles…

Es lo que ya hace el Banco de Japón, comprar acciones, comprar bolsa a través de ETFs, algo que podría empezar a hacer el BCE…, ya que cada vez le quedan menos bonos para elegir.

Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility

We think the ECB could legally buy ETFs that fit its requirements…

… but it would be controversial and we question the benefits

An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme

…and assuming a market-weighted allocation, it would benefit the core more than the periphery…

…while it is questionable whether it would have a major sustained impact on equity prices, economic growth and inflation

The risk of losses is higher for equities than investment-grade credit

Ultimately, we do not think that the ECB will follow other central banks and turn to buying equities via ETF purchases any time soon, if at all

We consider whether the ECB will turn to equity purchases

The ECB stepped up its unconventional policy around the middle of 2014, by taking its deposit rate into negative territory. Early in 2015, it launched a large-scale QE programme focused on public sector bonds. Since then it has added regional bonds and investment-grade credit bonds to the mix. Despite the positive effects on financial conditions, the outlook for growth and inflation remains disappointing. At the same time, there are market concerns that there are not enough bonds available to be bought and that current monetary policy is losing its effectiveness. This has led to questions about what else the ECB can add to its policy mix. In this research note, we consider whether the ECB will turn to equity purchases. We first look at whether equity purchases are possible from a legal and practical perspective and what such a programme could look like. We then go on to assess how effective buying equities would be in boosting equity prices, and hence growth and inflation, drawing on the experience of Japan. Finally, we look at the risks that the ECB would be exposing itself to. We do this in a Q&A format.

1. Would equity purchases be legal?

Although equities are not part of its collateral framework, and there will likely be legal challenges and controversy, there is no law against the ECB buying equities.

ECB officials have suggested it is an option

Comments from ECB officials suggest it is an option, with the main doubts relating to its effectiveness rather than its legality. Two of the most important comments were made by Chief Economist Praet back in October 2015 and by President Draghi at the Q&A session of the 2014 December Governing Council meeting. Reuters reported (see here) that when Mr Praet was asked whether the ECB would buy equities he cautioned that there might be little point in building a small position in a new asset class. Meanwhile, President Mario Draghi was asked which kind of options for asset purchases were discussed in the Governing Council (see here). He said that the inclusion of all assets was discussed, with the exception of gold.

Court rulings give ECB room to manoeuver

Meanwhile, the German constitutional court and European Court of Justice (ECJ) rulings on the OMT would comfort the ECB that any legal claims would bear little or no fruit. The German court decided that the OMT was permissible under German law. The decision therefore indirectly paved the way for the ECB to carry on with its QE purchases. Although the German court expressed concerns and gave six conditions, which the ECB must follow, we think that these would still allow equity purchases. The ECJ also ruled the OMT was legal, concluding that ‘the ECB must have a broad discretion when framing and implementing the EU’s monetary policy, and that courts must exercise a considerable degree of caution when reviewing the ECB’s activity, since they lack the expertise and experience which the ECB has in this area’.

Precedence from other central banks

In addition, there is a precedence of the policy being adopted by other central banks. The prime example is BoJ, but also other central banks like SNB, the Czech central bank and Hong Kong’s central bank have used this policy tool before.

2. How would the ECB buy equities?

BoJ’s ETF purchase structure could be used as blueprint

Since the ECB has never bought equities before, it lacks specific operational knowledge and experience in this area. We think that, as an example, the structure that the BoJ uses could work. The BoJ purchases equities by buying ETFs via a trust bank and a money trust, which track the Tokyo Stock Price Index (Topix), the Nikkei 225 Stock average or the JPX-Nikkei index 400.

Hiring an external manager is not new for the ECB as it appointed asset managers before for its ABS programme. As under the ABS programme, the ECB would continue to have full control over the purchases and will be able to give explicit instructions prior to approving the purchases. Furthermore, ETFs are known for their flexibility and they can be tailor-made to the central bank’s requirements. The inclusion of these assets will therefore increase flexibility for the ECB to target specific credit easing. For example, the BoJ tweaked its initial programme by buying ETFs that focus on domestic firms which proactively make investments in physical and human capital. More recently, the BoJ changed its purchase composition by skewing more buys to the market capitalised Topix index. The shift comes at the expense of the price weighted Nikkei 225. The ECB could use similar requirements and tweaks to ensure the breakdown in terms of the equity markets of the various member states that it regards desirable.

3. How big could an ECB ETF purchase programme be?

European ETF amounts to EUR 450 bn…

Here we can also use the BoJ experience as benchmark. The European ETF market currently amounts to around EUR 450bn, which is larger than the Japanese market (EUR 180bn) but much smaller than the US market (EUR 1.780trn), according to consultancy firm ETFGI. In comparison, the size of the European ETF market, roughly equals the size of the current eurozone regional bond market (EUR 400bn) and is somewhat smaller than the supranational market (500bn).

…but it could grow significantly

However, this is only a starting point as an ETF programme would lead the market to growing in size. The Japanese ETF market experienced strong growth following the stepping up of the BoJ’s ETF purchase targets. The Japanese ETF market experienced the strongest year-on-year growth in 2013, 2015 and 2016. For these years, the increase of ETF assets and the number of ETFs easily outpaced the Nikkei 225 index. The developments in 2016 are extraordinary as the Nikkei 225 index declined while ETF assets and the number of ETFs continued to grow. We think it is likely that the BoJ’s decision to buy additional ETFs in December 2015, which focus on investing in human and physical capital, has been supporting the growth of the Japanese ETF market.

Size of the programme could be around EUR 200bn…

The BoJ has increased and tweaked its ETF program on several occasions and is expected to buy at an annual rate of 6trn yen per year. The most recent data show that the BoJ owns about 60% of the total Japanese ETF market. It is difficult to know what impact an ECB ETF programme would have on the growth in the market. However, judging by the Japanese experience, a conservative assumption is that the market could grow by 30% on the announcement of a large scale ETF program by the ECB. This would mean that the market would increase from currently EUR 450bn to around EUR 600bn. Again taking a conservative approach, we estimate that the ECB would then be able to buy around 30% of the total size, which would equate to an ECB ETF programme of around EUR 200bn.

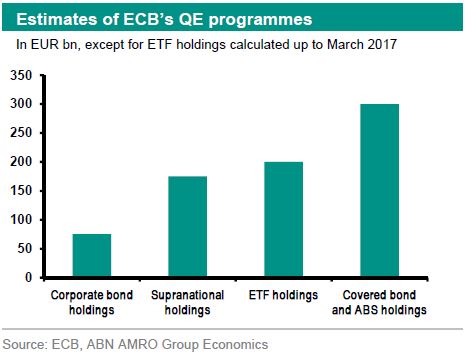

…which is small compare to overall QE programme

As a result, he ECB’s ETF programme could be much larger than our estimate of the corporate bond programme (EUR 75bn), roughly equal in size to our projection of the supranational purchases (EUR 175bn) but much smaller than our projection of the covered bond and ABS programme (EUR 300bn) let alone the government/national agency bond programme (EUR 1190bn).

This means that a potential ETF programme should firstly be regarded as an add-on instead of the new heart of the QE programme. However, the European ETF market could potentially grow much more rapidly than we assume, as was the case in Japan. So the risks to these estimates are to the upside. Still, it would not be large compared to the overall size of the QE programme.

4. Which countries would benefit?

ECB would move to market weighted approach and keep risk sharing regime

At the core of the rules of the current QE programme for government and national agency bonds, is the allotment of the QE purchases via the capital key and the regime in which national central banks are responsible for the risks arising from the purchases of their own national bonds. Although President Draghi recently said that the Governing Council has tasked the committees to explore the possibilities (including the capital key) for a smooth execution of the programme, we think that the ECB will be hesitant in changing these key concepts for the public sector purchase programme.

However, we note that the ECB has already moved away from the capital key for its corporate bond purchases, while it has also adopted risk sharing for this programme. Given the similar deviations of the equity and corporate bond market structures to the GDP weighted capital key approach, we would argue that the ECB would choose for a market weighted approach. In addition, we would argue that as in the case of the corporate bond programme, the ECB would adopt a risk sharing regime.

France, Holland and Germany would benefit, peripheral countries would lose

These choices would mean that certain countries could benefit from a market-weighted approach, assuming no additional tweaks, while others would be treated less favourably. The build-up of the iShares MSCI eurozone ETF index shows that France (32%), Germany (30%), the Netherlands (10%), Spain (10%) and Italy (7%) are the largest constituents. An analysis of the composition of the Stoxx Europe 600 index gives a similar ranking, when excluding non-eurozone members like the UK and Switzerland. An analysis on comparable ETFs issued by DB X-trackers and Vanguard gives broadly similar results.

When comparing the weights of the iShares MSCI eurozone ETF with the revised ECB capital key, France, the Netherlands, Germany and Belgium would benefit from a market-weighted approach. Peripheral countries would surprisingly benefit less as their capital key shares are larger than their weightings in the iShares MSCI eurozone ETF index.

5. Would an ECB ETF programme boost equity prices?

The experience of the BoJ’s ETF purchases, indicates that they did little to boost equity prices on a sustained basis in Japan.

On the surface, Japan’s NIKKEI index outperformed the MSCI world, the S&P 500 and the euro Stoxx indices between April 2014 and December 2015. This coincided with the stepping up of purchases in two steps in April and October 2014. The chart below shows the rise in ETF purchases roughly tracked Japanese equity outperformance during this period.

Equity gains following Japan’s ETF purchases probably reflect yen weakness

However, this is far from the whole story. First of all, Japanese equities have underperformed since December 2015 even though ETF purchases continued. Indeed, the recent further stepping up of purchases does not seem to have had much of an impact. So something else seems to have caused these swings. This brings us to the second point. The relative performance of Japanese equities seems to have been much more closely linked to movements in the yen over this period. The sharp fall in the yen spurred Japanese equities up to December 2015, and the subsequent rise in the yen led to their underperformance (see second chart).

Japan is not the only country where the authorities have ‘intervened’ in the equity market. Of course China’s recent experience of trying to prop up equities is also far from a success story. The bottom line is that there is a lot of uncertainty about whether ECB ETF purchases would have such a big impact on equity prices without going hand-in-hand with euro weakness.

6. Would equity purchases boost growth and inflation?

Most likely the effects on growth and inflation would be modest. QE works in five ways. First of all, it can boost the price of the assets purchased. Above we have expressed doubts about whether an ECB equity programme would have a major sustained impact on equity prices. But what if the ECB launched an ETF programme that did lead to a rise in equity prices of say 10% contrary to the evidence in Japan. Would that have a big impact on economic growth and therefore inflation? Here we are also doubtful.

Following the financial crisis, ECB economists looked at the impact on consumption from changes in household wealth. Their estimates of the change in consumption from a 10% rise in various types of wealth are shown in the table below.

Although the impact of a 10% rise in currency and deposits is very large (leading to a 2.4% rise in consumer spending in the long run) a similar rise in equities and mutual fund shares has a much smaller effect (0.3%). This would equate to an only 0.2% rise in GDP. One reason for the small effect is that eurozone households on aggregate tend to hold less equities relative to their income than those in other advanced economies. The impact on inflation would be similar to that on GDP at 0.1-0.2%.

A second way QE can work is through portfolio re-balancing effects. If the central bank buys safe assets such as government bonds, it can push investors out of these into riskier assets, boosting their price as well. These second round effects are unlikely in the case of equities as they are already at the far end of the risk spectrum in terms of eurozone assets. However, it could be that investors move outside of the eurozone, to for instance emerging market assets, which could push down the euro and therefore raise growth and inflation. Still, given the size of the programme and stickiness of mandates, the resulting fall in the euro would unlikely be large. This is especially the case in trade-weighted terms, given the eurozone’s trade is dominated by the US and other EU member states.

Third, credit easing. By increasing demand for equities, it may increase the availability of (in this case equity) finance for companies. These effects are probably modest given the current relatively favourable climate on equity markets. Fourth, QE puts liquidity into the banking system (as it buys assets and gives money to investors who eventually put it in the bank). It is hoped then that some of the liquidity in the banking system is lent out to households and companies. The ECB’s existing QE programmes have already reached EUR 1 trillion (and rising) so it is debatable whether an extra EUR 200bn would make a big difference in spurring liquidity and eventually bank lending.

Finally, there is a signalling effect. By buying equities, investors could change their perception of the ECB’s reaction function, and decide the central bank is willing to do whatever it takes. This in itself could raise inflation expectations, though it is difficult judge to what extent markets would be convinced, given some of the issues we have raised above.

7. What would be the risks associated with an ECB ETF programme?

The potential risks are relatively high. Although the ECB has recently increased the risk on its balance sheet by buying investment-grade corporate bonds, equity purchases are riskier still. The ECB does not have to worry about price swings with regard to investment-grade bonds because it is a buy-and-hold investor and therefore only needs to be concerned that the company will pay up when the bond matures. According to S&P, the cumulative default rate on investment grade debt is around 1%, which means that losses would be relatively limited.

On the other hand, the only way the ECB can get ETFs off its balance sheet is to sell them, so price swings matter. If equity prices were to fall sharply, there is no guarantee that they will recoup those gains over the time horizon that the ECB would like to sell. In addition, the Eurosystem’s accounting framework suggests that ETF holdings will need to be measured at end-of-period market value. That could mean that any price fall would show up relatively quickly.

Conclusion: ECB equity purchases seem unlikely in the near term

Overall, the ECB would be increasing the risk on its balance sheet for uncertain, and at best modest gains in economic growth and inflation. In addition, the ECB has other stimulus options (even though the effectiveness is diminishing). Furthermore, the current situation of moderate economic growth and relatively elevated equity valuations, also makes the case for ECB equity purchases weak.

In the near term, the ECB will likely extend its public sector purchases later this year, including taking measures to expand the universe of government bonds it can buy. We do not think launching an ETF programme is even a remote possibility.

Looking further ahead, if there were to be a large demand shock that led to a collapse in equity prices, that would make an a ETF purchase plan more likely. In the case that equity valuations were unusually depressed (as was the case following the financial crisis for instance) such a programme could also be more effective in boosting equity prices. However, even then, the cost-benefit analysis would likely make most members of the Governing Council cautious.

O quizás no hagan nada, les entre la sensatez, y dejen que la purga la haga el sistema sin intervenir más. Puede que lo que tengamos en el futuro próximo sea el tapering (reducir el volumen del QE del BCE)… Veremos. Abrazos,

PD1: Sentirse juzgado. Esa desagradable sensación que uno percibe cuando alguien te mira de arriba abajo con detenimiento. A mi me pasa mucho cuando llego y ven mi coche: un viejo Dacia Sandero que no suele andar muy limpio (lo lavo una vez al año ya que considero que no debemos vivir para el coche), y anda con bastantes rozaduras de aparcamientos indebidos… (mis hijos son los culpables).

Pero no sólo es el coche, es cuando llegas a un sitio y te miran y remiran y suben la cabeza para verte la cara y bajan a mirarte hasta los zapatos…, como si te desnudasen. Esto ocurre en todas las edades, lo hacen los jóvenes entre sí, y los mayores también. De ahí la moda, para evitar murmuraciones de lo mal vestido que vas, de ahí querer estar vestido a la moda, para recibir la aprobación del de enfrente…

Cuando me lo hacen, cuando me fulminan con la mirada, que se nota, no siento rubor alguno, sino que rezo algo por aquél que me lo está haciendo, para que no se crea superior… Ay de la soberbia, ay!!! Qué bonita es la sencillez y mirar al otro con ojos limpios, sin tener que juzgarle por su apariencia, por lo que tiene, por lo que hace.

En la familia, entre padres y los hijos que viven con los padres, esto no se suele hacer. Es en la familia donde más amor existe: se acepta al otro como es y no se le juzga continuamente. Los padres corrigen a sus hijos, es su deber…, son esos matices de ir educándoles en valores, en el vestir, en el hacer. Se hace porque se les quiere, no para hacerles un calco a sus progenitores, ni mucho menos. Y no les jugamos. Los hijos tampoco andan juzgando a los padres… Hay un momento en que nos ven viejos y piensan que somos de otra época…, pero no nos juzgan, nos quieren, a pesar de la difícil adolescencia que acaba pasando…

No, vivimos para juzgar a todos, para decidir lo que se tiene que hacer, lo que está bien hecho, lo que uno debe vestir, el coche que debe tener, que si es muy caro, que si es demasiado bueno, que si va muy desaliñado, que si va demasiado a la moda, que si tiene mucho tacón, que si es un frívolo, que si se ha separado, que si no atiende a sus hijos…, siempre juzgando. Malo, malo… Esto sí que no es cristiano.