Se está descontando todo por adelantado… No habrá nada para ganar en los próximos años. Nos espera una década próxima sin nada para llevarnos al galeto, sin rendimientos de bonos, sin plusvalías de las acciones… ¿Qué hacemos con nuestro dinero?

There will be "almost no prospective returns" from U.S. stocks over the next decade because the market is fully valued following years of gains, according to the global strategist at Allianz Global Investors, which manages $569 billion.

As Bloomberg reports, low interest rates and bond purchases by central banks have left cash and many other asset classes "significantly mispriced," Neil Dwane said Monday as part of a panel discussion on long-term investing at the Toronto Global Forum.

"The U.S. is fully valued," said Dwane, whose firm is owned by Munich-based insurance giant Allianz SE.

"There’s almost no prospective returns for the next 10 years from the U.S. equity market, and therefore investors have to look into Asia or Europe where valuations are significantly lower."

With interest rates close to zero around the world and bond markets "manipulated by central banks," it’s difficult to assess risk and return, he added.

Many investors have turned to high-yield bonds or emerging markets for income, which raises risks.

Dwane is not alone of course in this ominous view, as Bloomberg notes, Jim Keohane, chief executive officer of the Healthcare of Ontario Pension Plan, agreed that it’s not a good time to be buying assets of nearly any stripe.

"Right now assets are very expensive," said Keohane, whose firm manages more than C$70 billion ($54 billion).

"We need to be patient, to wait for better opportunities. Whenever the next crisis comes, assets are going to be on sale. You can buy them a lot cheaper than you can buy them today, but you have to have patience to be able to do that."

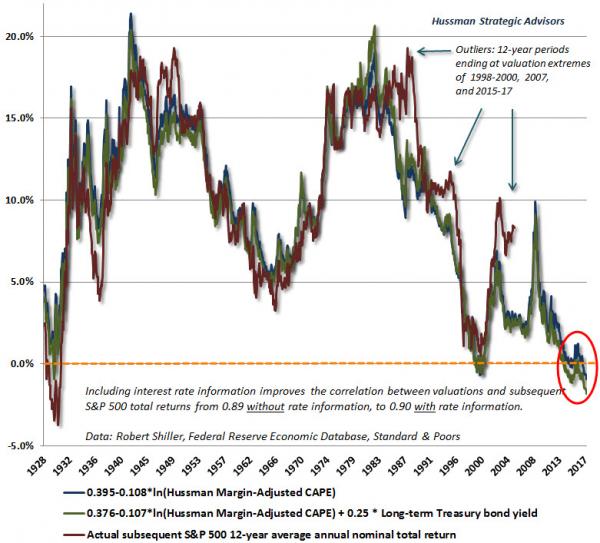

And finally, John Hussman, of Hussman Funds, warned that a century of reliable valuation evidence indicates that the S&P 500 is likely to experience an outright loss, including dividends, over the coming 10-12 year horizon, and we presently estimate likely interim losses on the order of -60% or more.

A rate of return of even 1% in cash is a much more desirable option than investors may imagine.

For a while, Bernie Madoff’s investors felt great about their impressive “returns.” For a while, investors in dot-com stocks felt the same. For a while, investors in mortgage bonds felt the same. But when investors focus on returns rather than the very long-term structure, stability, and even existence of the underlying cash flows, terrible things can happen.

All that’s required to get the snowball rolling is the creeping recognition that there’s no “there” there.

In response to the delusion that low interest rates “justify” virtually any level of market valuation, regardless of the growth rate of the underlying cash flows, the speculation of recent years has created a situation where there is effectively no way out for investors in aggregate. Every security that is issued must be held by someone until it is retired.

When one investor sells a share, it simply means that another investor buys it. The only question is who will hold the bag.

Abrazos,

PD1: Si el rendimiento de las inversiones es muy bajo en el futuro, porque se ha ido descontando por anticipado todos los futuribles buenos, donde más daño va a haber es en las expectativas de rendimientos de los planes de pensiones. En el caso de EEUU, que hay un GAP enorme entre lo que se tiene que pagar y lo que se tiene, este gráfico lo explica muy bien:

Son muchos trillones de dólares los que se van a esfumar, o poner de otro sitio, o decirle al pensionista que va a cobrar mucho menos… y tal.

PD2: Y en España nos coge con un ahorro en mínimos. Parecía que salíamos de la crisis. Muchos se han apuntado al consumo, viendo que esto estaba más tranquilo, y se pide crédito… Pero cuando vengan de nuevo las vacas flacas, que están a la vuelta de la esquina, no hay ahorros para tirar de ellos…. Es terrorífico:

PD3: Padre Pio:

"Si callas, cállate por amor;

Si gritas, grita por amor;

Si corriges, hazlo por amor;

Si perdonas hazlo también por amor"