En diciembre, la FED subirá los tipos de interés otro escalón. Los mercados andarán muy condicionados por la estrategia de revertir los estímulos QE durante 2018, hasta ver como no hay ninguna ayuda de los bancos centrales…

In all the euphoria over yesterday's "dovish taper" by the ECB, markets appear to have forgotten one thing: the great Central Bank liquidity tide, which generated over $2 trillion in central bank purchasing power in 2017 alone - and which as Bank of America said last month is the only reason why stocks are at record highs, is now on its way out.

This was a point first made by Deutsche Bank's Alan Ruskin two weeks ago, who looked at the collapse in global vol, and concluded that "as we look at what could shake the panoply of low vol forces, it is the thaw in Central Bank policy as they retreat from emergency measures that is potentially most intriguing/worrying. We are likely to be nearing a low point for major market bond and equity vol, and if the catalyst is policy it will likely come from positive volatility QE 'flow effect' being more powerful than the vol depressant 'stock effect'. To twist a phrase from another well know Chicago economist: Vol may not always and everywhere be a monetary phenomena – but this is the first place to look for economic catalysts over the coming year."

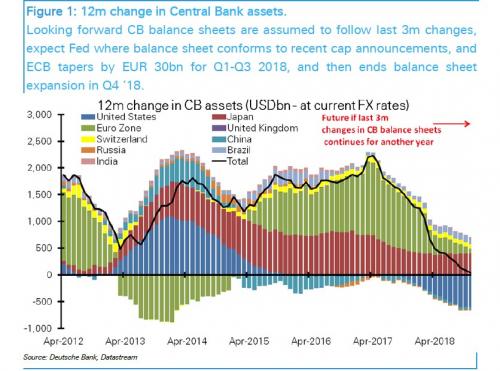

He showed this great receding tide of liquidity in the following chart projecting central bank "flows" over the next two years, and which showed that "by the end of next year, the combined expansion of all the major Central Bank balance sheets will have collapsed from a 12 month growth rate of $2 trillion per annum to zero."

Shortly after, Fasanara Capital's Francesco Filia used this core observation in his own bearish forecast, when he wrote that "the undoing of loose monetary policies (NIRP, ZIRP), and the transitioning from 'Peak Quantitative Easing' to Quantitative Tightening, will create a liquidity withdrawal of over $1 trillion in 2018 alone. The reaction of the passive community will determine the speed of the adjustment in the pricing for both safe and risk assets."

Fast forward to today, when Bank of America's Barnaby Martin is the latest analyst to pick up on this theme of great liquidity withdrawal.

Looking at (and past) the ECB's announcement, Martin writes that "as expected, Mario Draghi took a knife to the ECB's quantitative easing programme yesterday. From January 2018, monthly asset purchases will decline from €60bn to €30bn, and continue for another 9m (and remain open ended). The ECB now joins an array of central banks across the globe that are either shrinking their balance sheets or heavily scaling back bond buying."

So far so good, and in itself, this structural tightening when coupled with the open-ended nature of the ECB's taper was ultimately perceived as very dovish for markets, sending not only the EUR plunging over 200 pips in the past 2 days, but sending Eurozone yields jumping, as the ECB telegraphed it was very much uncertain when, and if, it would truly be able to untangle itself from QE, especially since the ECB still can increase the 33% limit on bond purchases if needed be after 2018 to return back to a quantitative easing paradigm, one which may well include the direct purchase of equities and ETFs, as in the case of the SNB and BOJ.

Furthermore, as Martin adds, heading into the ECB decision "the market had a warm reception for yesterday's big QE cut: 5yr bund yields declined 5bp, European equities finished the day up 1.3% and iTraxx credit spreads ended 2bp tighter. In fact, we think markets were very relaxed heading into yesterday's landmark decision. Chart 2 shows that European rates volatility reached an all-time low of 33.2 towards the end of last week. Such was the market's comfort with the notion that Draghi would offset the drop in QE with heavy doses of forward guidance…and he indeed delivered lots on this front yesterday"

However, as Ruskin and Filia warn, Martin underscores that it is the bigger point that is ignored by markets, namely that it is all about the "flow" of central bank purchases. And in this context, the BofA strategist warns that it will take just over a year before the global liquidity tide not only reaches zero, but turns negative... some time in early 2019.

Chart 1 shows year-over-year changes in global asset purchases by central banks (we also include China FX reserves here). Given this year's slowdown in ECB and BoJ QE (the latter, in particular, is striking in USD terms), we are well past the peak in global asset buying by central banks. But with the Fed now embarking on balance sheet shrinkage, the start of 2019 should mark the point where year-over-year asset purchases finally turn negative - a trend change that will come after four straight years of expansion.

Still, despite virtually every strategist on Wall Street being familiar with this chart, few if any want to believe it. In fact, the favorable reception to what is fundamental a tightening shift by the ECB poses what Martin notes, is a the big risk to corporate bond markets, "for as long as the ECB's message on rates is dovish, the incessant inflow story into European credit is unlikely to die. And big inflows mean "overwhelming" credit technicals would persist for the foreseeable future (see chart 3 below). Thus, credit bubbles become a legitimate risk down the line."

To be sure, there is just one event that could end this hypnotized paralysis: inflation, which however stubbornly refuses to emerge, which is why "the market seems to have dismissed the idea that inflation could surprise to the upside" However, "should it rise quicker than expected, we sense the dovish rhetoric from central banks would quickly change. And we believe that this may be all that's needed to snuff out the great "reach for yield" trade that is currently gripping European corporate bonds."

And therein lies the rub: will inflation finally appear and prevent the world's biggest asset bubble from becoming even bigger, or - as Eric Peters warned two weeks ago - will the "Nightmare Scenario" for the Fed emerge, and even as asset prices rise ever higher, inflation remains dormant:

If we don't see a sustained cyclical jump in wages, then yields won't go up. And if yields don't go up, then the asset price ascent will accelerate... Which will lead us into a 2018 that looks like what we had expected out of 2017; a war against inequality, a battle for Main Street at the expense of Wall Street, an Occupy Silicon Valley movement. Then you'll have this nightmare for the next Federal Reserve chief, because they'll have to pop a bubble.

In conclusion, we go back to the person who first observed the dramatic shift in central bank flow, Citi's Matt King, who had this to say:

To us, QE flows (i.e. marginal net purchases) rather than the stock of central bank holdings are the more important driver of asset prices. As we noted recently, if all major European investor types are already net selling or at least not buying € FI securities at prevailing market prices, then why should they stop or even start buying when the safety is withdrawn? Unless you have an emphatic answer, then with ECB QE falling by at least €500bn next year, according to our economists, and the Fed reducing its holdings of securities by almost $500bn at the same time, it would perhaps be best to tread cautiously.

Abrazos,

PD1: Esto dice Morgan Stanley:

As increasingly more analysts and Fed-watchers have suggested in recent months, the one catalyst that could send the market into a tailspin is for the Fed to get what it has so long wanted: a sudden spike in inflation. From Albert Edwards (who looks at record U.S. vacation plans as an ominous sign of rising wages), to Eric Peters (who warned that pent up inflation could unleash a "nightmare scenario" for the next Fed chair), to Aleksandar Kocic (who yesterday explained why the market is vulnerable to bear steepening of the curve with the Fed "massively negatively convex to inflation risk"), on Sunday Morgan Stanley's chief cross-asset strategist, Andrew Sheets joins the warning and observes that at a time when things are finally starting to look up for the global economy, "this puts central banks in a challenging position. Inflation remains below target. But current policy means some of the easiest financial conditions ever observed, just as growth is picking back up, regulation is backing down and memories of the last crisis fade."

As a result, Sheets believes that "current policy rates and financial conditions look unsustainably easy relative to the strength of global growth." Which means that the response is once again in the hands of Central banks, who hold the key to determining when to push back. "If they do, asset prices face a severe challenge" Morgan Stanley warns, but maybe not yet: "until they do, we should be willing to accept that prices can persist above 'fair value'."

Andrew Sheets' full note is below:

Overstimualted

With rates low and central banks taking great care to avoid surprises, the question isn't why many assets are expensive. It's why they aren't richer. Since the financial crisis, easy policy has been balanced by four powerful counterweights. All now appear to be shifting, opening the door to more volatile late-cycle behaviour.

It's easy to talk loosely about 'loose policy' and 'easy money'. So let's be specific. When rates sit below the level of inflation, borrowing to buy almost anything makes financial sense. It's true for a toaster or a house or a company, and that's exactly the point; easy policy aims to stimulate and bring forward depressed demand.

And boy do we have easy policy. The G4 policy rate (GDP-weighted) is 150bp below the rate of inflation. G3 central banks hold ~US$14 trillion of assets, compared to ~US$3 trillion pre-crisis. And that's set to keep increasing through 3Q18, even as the Fed's balance sheet starts to shrink.

But it's not just that policy is easy. It's also highly predictable. Qualitatively, the Fed, ECB, BoJ and BoE have gone to great lengths to communicate policy aims and changes well in advance. Quantitatively, implied volatility on interest rates (a proxy for the uncertainty in policy) is near all-data lows.

1.Fiscal tightening: The US, UK, eurozone and Japan all tightened fiscal policy in the aftermath of the Great Recession, despite still-wide output gaps. This rejection of Keynes countered the simulative effects of monetary policy, and certainly contributed to the sluggish nature of the post-crisis recovery.

2.Regulation: The crisis exposed huge shortfalls in risk management and capitalisation, and in the aftermath lawmakers (globally) moved to address both aggressively. Stress tests were introduced, leveraged lending was discouraged and tighter rules were placed on securitisation. All discourage risky behaviour, despite the presence of low policy rates.

3.'Scars of the crisis': Not all financial regulation came from government bodies. Some of it, we'd venture, was self-imposed. The crisis crushed optimists, rewarded pessimists and created emotional and financial scars that weren't going to heal quickly. While harder to quantify, we think that this contributed to a level of corporate and financial timidity despite exceptionally low policy rates.

4.Low nominal growth: Tighter fiscal policy, financial deleveraging and corporate investment caution all helped to push global growth to levels that left little room for error. From 2011-15, global growth hovered around 2%Y, and lacked synchronicity, with DM initially struggling while EM did better, and then vice versa. If growth is weak (and people expect it to remain so), low rates can lose much of their power.

All of those 'checks' are starting to fall, at the same time. G4 fiscal tightening is becoming fiscal easing (US tax cuts at this level of unemployment have little precedent, and our UK economists expect looser spending in the autumn budget). Financial institutions are now well-capitalised and regulation (broadly speaking) has stopped tightening. The scars of the crisis are fading, as more investors wade back into previously off-limits asset classes. And global growth is humming, with our economists seeing the strongest levels since 2010.

This puts central banks in a challenging position. Inflation remains below target. But current policy means some of the easiest financial conditions ever observed, just as growth is picking back up, regulation is backing down and memories of the last crisis fade.

What's the takeaway? We focus on four:

+Current policy rates and financial conditions look unsustainably easy relative to the strength of global growth. Central banks hold the key to determining when to push back. If they do, asset prices face a severe challenge. But until they do, we should be willing to accept that prices can persist above 'fair value'.

+Markets, oddly, don't see this dynamic as unsustainable, and imply easy and predictable G4 policy to persist for years. Our rates strategists believe this provides medium-term support for US 2s30s flatteners, given a view that the Fed will hike more than the market is pricing, and selling the MBS basis, which is exposed to very low levels of rate volatility. Conversely, the recent EMFX sell-off looks outsized relative to G4 rate expectations, and our strategists see an opportunity to buy local rates in Indonesia, Colombia and Hungary.

+Extraordinary stimulus, with fewer breaks against it, increases the chance of a 'boom/bust' environment. In equities, we think this makes stock replacement attractive (replacing index with calls), given low volatility and a steep skew. Cross-asset, we think this favours long equities versus credit.

+Higher oil prices would represent a tightening of financial conditions outside of central bank control. We are OW energy in the US and Europe, and think the sector has attractive diversification for this risk scenario.

PD2: Y así se ve desde España:

MÁS LIQUIDEZ, NO MENOS

La actuación de los bancos centrales, interviniendo en los mercados de bonos e inyectando liquidez, ha condicionado y seguirá condicionando la evolución de los distintos mercados financieros. La Reserva Federal (Fed) ha marcado el paso de las decisiones a tomar tanto en la fase de expansión monetaria como en la fase de posterior de vuelta a la normalidad monetaria.

Primero redujo los tipos de interés a cero. A diferencia del BCE, la Fed no cometió el error histórico de situar los tipos de interés en negativo (algo que se estudiará en los libros de historia económica).

Posteriormente, aplicó sucesivos programas de compra de bonos soberanos y privados (QE: Quantitative easing).

Bernanke, el anterior gobernador de la Fed, anunció en mayo de 2013 que en algún momento dejaría de incrementar su balance comprando bonos, reduciendo paulatinamente el volumen de compras. En enero de 2014 comenzó el "tapering" o reducción del volumen de compra de bonos mensual. Las compras finalizaron nueve meses después.

Una vez finalizados los distintos programas de compra de bonos, la Fed ha continuado reinvirtiendo en compra de bonos los importes correspondientes a los bonos mantenidos en cartera que vencen. De esta forma, durante casi tres años el balance de la Fed se ha mantenido estable a pesar de no estar en funcionamiento ningún programa de compra de bonos (QE).

Hace ya un año la Fed comenzó a subir de forma muy paulatina y controlada los tipos de interés. A pesar de que la propia Fed estima que subirá una vez más los tipos de interés este año, tres veces en 2018 y otras tres subidas en 2019, el mercado apenas descuenta dos subidas en el periodo de los próximos dos años.

Finalmente, a partir de este mismo mes de octubre la Fed dejará de reinvertir bonos vencidos por importe de 10.000 millones de dólares al mes incrementando la cifra en otros 10.000 millones de dólares adicionales cada trimestre hasta alcanzar un nivel de 50.000 millones al mes al final de 2018. Simplemente la no reinversión de bonos a su vencimiento hace que el balance de la Fed se vaya a reducir en los próximos años.

El Banco Central Europeo ha ido por detrás de su homólogo estadounidense desde el principio de la crisis, pero con un cierto decalaje sigue los mismos pasos. Por tanto, es fácil estimar cuáles serán las decisiones futuras de la autoridad monetaria de la Eurozona.

El BCE tardó más en bajar los tipos de interés. De hecho, cometió el error de subirlos en 2008 y 2011. Finalmente, ha llegado a situar los tipos de interés a corto plazo en negativo. Algo económicamente difícil de justificar.

El BCE comenzó mucho más tarde los programas de inyección de liquidez, primero a través de "barra libre" de liquidez (LTRO) para que fuesen los bancos quienes compraran los bonos soberanos, y más tarde, desde marzo de 2015, comprando él mismo los bonos soberanos y posteriormente corporativos.

Ahora, el BCE acaba de anunciar que continúa con la compra de bonos, pero reduciendo el volumen de adquirido cada mes: 30.000 millones de euros al mes de enero a septiembre en lugar de los 60.000 millones mensuales actuales.

En algún momento del próximo año anunciará que deja de adquirir bonos. Aun así, ya ha dejado claro que seguirá reinvirtiendo el importe correspondiente a los bonos en cartera que venzan. De esta forma se mantiene el tamaño de su balance: la liquidez no aumentará, pero tampoco se reducirá.

Llegados a ese punto, comenzará el proceso de vuelta a la normalidad monetaria.

En algún momento subirán los tipos de interés, aunque el propio BCE augura que esto no sucederá por un periodo prolongado de tiempo posterior al fin de las compras. (The Governing Council continues to expect the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases). Por lo tanto, no son esperables subidas de tipos hasta bien entrado 2019.

Aunque quede lejano en el tiempo, en algún momento el BCE dejará de reinvertir gradualmente el importe de los bonos vencidos. Quedan años para que esto suceda, pero acabará sucediendo al igual que ya ocurre en EE.UU.

El camino a la normalización monetaria será largo y no está exento de posibles pasos atrás y más inyecciones de liquidez si la economía se tuerce o ante la eventualidad de un shock imprevisto. La digestión de esta normalización por parte de los mercados financieros no será fácil. La complacencia de los mercados no durará eternamente, como tampoco lo hará la política expansiva del BCE

PD3: El Papa Francisco ha admitido que a veces se quedaba dormido mientras reza, al tiempo que aseguraba que es una de las muchas maneras de "santificar el nombre de Dios". "Yo también cuando rezo, a veces me duermo", dijo sonriendo el pontífice argentino en una entrevista. "Santa Teresa del Niño Jesús dijo que ella también lo hizo y que le agradó a Dios", agrega antes citando un salmo que llama al creyente a "estar delante de Dios como un niño en los brazos de su padre". "Esta es una de las muchas formas de santificar el nombre de Dios, de sentirme como un niño en sus brazos", dice el Papa, sugiriendo que no hay mejor lugar para quedarse dormido.