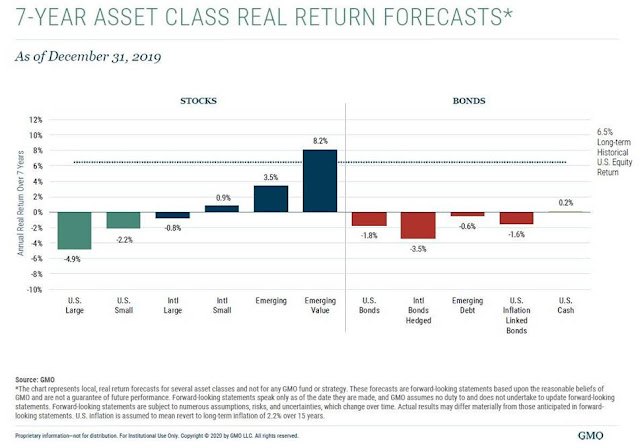

Nunca aciertan en sus pronósticos, pero me encanta leer sus previsiones. Es la rentabilidad que esperan para cada uno de los activos en los próximos 7 años. Sigo pensando que algún día acertarán y se cumplirá ese buen pronóstico de los mercados emergentes, a pesar de lo que está cayendo ahora con el virus…

GMO 7-Year Asset Class Forecasts: An Amazing Capstone To A Risk-On Year

“The good news first. The fourth quarter was an amazing capstone to a risk-on year. Virtually all risk assets rallied impressively. US, Non-US, and Emerging stocks, growth, value, large and small. Certain pockets in the equity markets posted double-digit returns in the quarter alone. Credit markets rallied, such as High Yield and Emerging Market Debt. You name it, and it was up,” says Peter Chiappinelli, Asset Allocation Portfolio Strategist at GMO.

“Now for the bad news. Much of 2019’s impressive run up for US large cap equities was based not upon fundamentals but upon P/E multiple expansion. Profit margins, in fact, declined substantially in the fourth quarter --- yet the “P’s” kept rising. And this expansion was on the back of what was already an expensive market. We ended 2019 with the Cyclically Adjusted Price to Earnings CAPE) for the S&P 500 at 31, putting it at extreme levels, well past the bubble levels of 2007 and within whispering distance of October, 1929.

"Back to the good news, however. The rest of the world, particularly value stocks in Emerging Equities, are trading at substantial, near historic, discounts to the US. So there is money to be made --- good money in fact, as our 7 year forecasts for emerging value stocks is over 8% real, with possible additional returns coming from their cheap currencies. But it gets better. Value stocks across the planet, in fact, are also trading at substantial discounts to their Growth brethren. We are also quite constructive on our alternatives portfolio, which can further exploit these valuation differences without taking beta or duration risk.

"The last time we saw this wide a “spread” in expected returns between a traditional 60/40 portfolio and a non-traditional one was back in the late 90s, and we all know what happened from there. The traditional 60/40 portfolio went on to have a “Lost Decade”, making essentially no money, in real terms, for ten years. Ouch. Sadly, as the chart below points out, Lost Decades have happened with alarming and surprising frequency, all preceded by expensive stocks or expensive bonds. Today, both are expensive.

"In fact, the amazing run-up of the traditional 60/40 portfolio over this year and this decade can mean only one thing to this valuation-sensitive, i.e. contrarian, investor: now is the time to be moving away from 60/40.”

Abrazos,

PD1: Siento si soy muy aburrido…, tengo que ser más creativo y divertido en la posdata…