Yo creo que no, que es un rally estimulado por dinerito recientemente impreso que no tiene solución de continuidad… ¡Hasta el infinito y más allá! No, no pueden darle más a la maquina que la van a quemar… Ayer hubo un rumor que se acababa el QE en EEUU y se desmoronó. ¿Qué pasará si se confirma o cuando se confirme que no se imprime más?

David Rosenberg - The Potemkin Rally

Gluskin Sheff's David Rosenberg exclaims we are currently are witnessing the Potemkin rally (the phrase Potemkin villages was originally used to describe a fake village, built only to impress). The term, however, is now used, typically in politics and economics, to describe any construction (literal or figurative) built solely to deceive others into thinking that some situation is better than it really is. Ben Bernanke, recently proclaimed “The Hero” by Atlantic Magazine, is the “Wizard of Potemkin.” Since 2009 Bernanke has engage in massive monetary experiments. These experiments lead to future dislocations. There is no doubt that the Fed wants inflation. The problem is they may get more than they ask for.We are currently witnessing the slowest economic recovery of any post-WWII period. However, It is important to challenge your thought process. Read material that challenges your views. Here are David's rules...

In Part V of the series of reports from the 10th annual Strategic Investment Conference, presented by Altegis Investments and John Mauldin, David Rosenberg presents a rather shocking shift from his primary thesis over the last 3 years.

You can read the previous presentations by clicking the links below.

David Rosenberg is the Chief Economist and Strategist for Gluskin-Sheff. Here are his views:

The Potemkin Rally

{StreettalkLive Note: At the end of David's speech he stated that this is a "coffee table" presentation. This view will likely take some time to develop and that from time to time we will need to reveiw it to see where we are. This should not be taken as something that he expects to happen tomorrow.}

We currently are witnessing the Potemkin rally. For a quick background the phrase Potemkin villages was originally used to describe a fake village, built only to impress. According to the story, Russian minister Grigory Potemkin who led the Crimean military campaign erected fake settlements along the banks of the Dnieper River in order to fool Empress Catherine II during her visit to Crimea in 1787.

The term, however, is now used, typically in politics and economics, to describe any construction (literal or figurative) built solely to deceive others into thinking that some situation is better than it really is.

Ben Bernanke, recently proclaimed “The Hero” by Atlantic Magazine, is the “Wizard of Potemkin.”

Since 2009 Bernanke has engage in massive monetary experiments. These experiments lead to future dislocations. The chart below shows that for every dollar increase in the Fed’s balance sheet it has translated into $1 of NYSE market capitalization to GDP.

There is no doubt that the Fed wants inflation. The problem is they may get more than they ask for.

The Potemkin Economic Recovery

We are currently witnessing the slowest economic recovery of any post-WWII period.

However, It is important to challenge your thought process. Read material that challenges your views. Here are my rules.

Bob Farrell once stated that

"...when all experts agree something else is bound to happen."

The reason my love affair has ended with bonds is thatdeflation has become the consensus view. Take a look at the following chart which shows that 80% of shortfall in growth is caused by slower potential.

There has been a secular decline in Potential GDP growth.

Here is a question for you. How does 1.8% GDP growth rate over the last year drop the unemployment rate by 60 basis points from 8.1 to 7.5%? That math simply doesn’t work.

The growth rate of GDP has fallen significantly and this should not be ignored. Historically, the economy could grow at 4% without creating inflation. With the current makeup of the economy today that is no longer possible. This is why we are likely witnessing the early stages of the transition from deflation to inflation and the end of my “love affair” with bonds.

One of the factors that will be supportive of an economic push will be the end of the household deleveraging cycle. I think that the end of the deleveraging cycle is about 2 years away. As you can see in the next slide borrowing has started to rise once again and will be a tailwind for the economy. This has been the primary goal of the Fed’s QE programs - boost asset prices to stimulate consumer confidence and borrowing. There is a problem though.

We have the weakest growth in the private capital stock in 60 years. Business spending as a share of GDP is at recession levels

While consumer confidence may improve as asset prices are inflated. It is not the same for CEO’s who are unlikely to make a commitment to the economy anytime soon. The NFIB survey shows that government regulations are a top concern that is inhibiting investment.

With capital formation low, which drags on productivity, it keeps the labor market weak. The labor market is plagued by a structural shift in its makeup and type of jobs available.

There are currently more than 90 million people outside the labor force and the available labor supply is shrinking.

Here is the reality. In the last four years we have created 3 million jobs while more 9 million people left the labor force.

The latest employment report showed a rise in employment and a fall in the employment rate. However, the household report showed a surge in the number of “self-employed” – these are individuals who are likely working out of their basement with no customers.

If you take a look at the JOLTS survey you will see that companies are looking for workers. Job openings have been on the rise. However, as we have seen in the recent NFIB surveys they cannot find the skilled workers to fill those jobs. This is why layoffs and discharges are at record lows.

Streettalk Note: This is known as “’Labor Hoarding” which is also why we are seeing jobless claims fall without substantive increases in employment. Fewer layoffs leads to lower claims but full-time employment relative to the population remains close to 2009 lows.

Here is my contention. At 7.5 % unemployment we are likely much closer to full employment than the Fed believes. The number of firings is 10% lower now than it was when the unemployment rate was at 4.4%. Think about that.

This is why the workweek has begun to expand. Businesses are running at minimum levels of employment so they are working current employment longer. This is leading to rising wages which is one of the key components of inflation.

Productivity growth is heading lower because of lack of capital formation. However, unit labor costs are rising which, as I said, has a high correlation to inflation. The bad news is that rising wage costs negatively impact profit margins.

The Fed funds rate has been pushed to zero. During that same period the Fed’s balance sheet has exploded. Just FYI – the fed’s balance sheet has jumped by 40% at an annual rate in the last 3 months which is why the market has hit new highs. The bottom line is that the Fed’s balance sheet is replacing the fed funds rate. Ben wants assets to go up to stimulate confidence.

However, the most compelling argument for stocks – yield spread.

But think about this - junk bonds are trading with a yield of 5% - really? That’s where AAA treasuries were 5 years ago. What is that telling you about investor risk taking?

Here is another question? What correlates with bond yields the closest? You guessed it - Fed policy.

The Fed has been talking about the Journey since 2009. Now they are talking about the destination with specific targets on inflation and employment. However, the problem for the Fed is that they may get more than they wish for. When inflation begins to rise it is extremely hard to stop.

While I agree that the Fed should be stimulative…the extent of the stimulative action so far has been too radical. This will lead to inflation in the future.

Currently, the U.S. is sporting a near 6% output gap. The problem is that an output gap of nearly 6% doesn’t correspond with a 1.6% inflation rate. At that level we should be seeing negative inflation rates. From my work I think that the output gap is more likely 2-3% which means that the Fed should be tapering off their actions now…rather than later.

Here is the problem currently. The real fed funds rate is very negative. The last time this occurred was when Author Burns was Fed chairman. The following two decades were not kind.

Furthermore, negative real rates in the past...

...have always led to asset bubbles.

The reason I am getting divorced from my love affair with bonds is that when inflation eventually rears its head - those individuals long high yield bonds, and unhedged, will lose.

My view since joining Gluskin-Sheff has been “Safety & Income At A Reasonable Price” which I am now shifting to “H.I.R.P - Hedged Inflation Risk Protection.”

Abrazos,

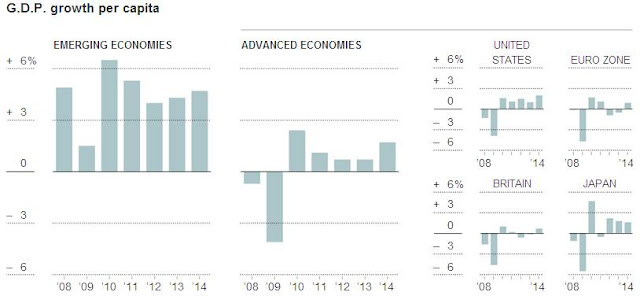

PD1: El NYT, con fuente del FMI y sus previsiones, publica estos interesantes datos: Tu eliges. O inviertes en las economías desarrolladas que tienen a sus bolsas en máximos de toda la vida y cuentan con un peligro grave, o inviertes en las emergentes y, a pesar de tus miedos, confías en que sean la mejor apuesta del largo plazo, si es que es este tu horizonte de inversión. Si inviertes pensando en un mes, no lo hagas conmigo que no sé lo que va a pasar en un mes. Si inviertes pensando en 5 años, piensa primero, elige después…, y no compres nada que te vaya a dar el más mínimo disgusto. Nunca actuamos lo suficientemente rápido, siempre nos pilla el toro…, nunca se hacen bien los picos y valles. Compra lo bueno, te sientas en tus inversiones, y esperas el rendimiento…

PD2:Si hubiera una QUITA de la deuda pública española, ¿quién palmaría su pasta? Según el Banco de España, los últimos datos de la tenencia de la deuda pública son terroríficos para los guiris y para la banca española… ¡Que no nos pase naaaa!:

Alucinas con la columna de la derecha, el total de deuda del estado. Ha pasado desde los 116.000 millones de euros de 1995 hasta los 555.991 millones actuales. Ay madre. A esto súmale la burrada de deuda que acumulan las CC.AA., los ayuntamientos (¡ay Gallardón como te pasaste!), de empresas públicas y llegas a la friolera de los 900.000 millones de euros, el 90% del PIB. Esto suponen la barbaridad de 38.500 millones de pago por intereses… Por cierto, Gallardón fardaba ayer de que nos íbamos a ahorrar 1.000 millones de euros por la artificial bajada de la prima de riesgo. Sí, en vez de costarnos los intereses de la barbaridad de deuda que acumulamos la friolera de 38.500 mill, nos van a costar 37.500 millones. Por segundo cierto, vamos a tener un déficit este año de 60.000 millones, ¿qué más nos da que tengamos 59.000 mill si siguen siendo demasiados? ¿Recortamos algo o qué?

No te menciono la necesidad de refinanciación que tiene la economía española. No dudo que cuando vayan viniendo vencimientos no sean renovados. ¿Te crees que los bancos alemanes y franceses van a seguir teniendo todo este mogollón de papelitos españoles con estos números? Ni de coña. Nuestra capacidad de pago no existe. Nuestra generación de caja, en una España deprimida y paralizada es nula… Mantenemos esta ficción, que es sólo eso, una pura ficción… Pero no, nos escoñamos en breves…, no des un chavo por nosotros.

Deuda Pública en manos de extranjeros:

Debemos 206.000 millones de euros a los guiris, que se suman a los 300.000 millones que deben los bancos españoles al BCE, que se suman a los 60.000 millones que deben las cajas nacionalizadas al BCE, avaladas por el Estado Español, al préstamo para salvarlas, que se suma a una deuda exterior de 1.000.000 millones de euros, de la que nadie habla, que se suma a colaterales, avales de los bancos… y mucha más mierda oculta que nos pone en el disparadero chipriota en cualquier nanosegundo… Tu espera macho, ya verás que leche nos vamos a dar…

Y sí, los políticos tienen la obligación de dar una patada hacia adelante, seguir mintiendo a los españoles con que esto va cojonudo, como cuando nos mentían con el ladrillo, como cuando permitieron las preferentes…, para salvar su culo… ¿No es todo un engaño? Pozzz, zziiii

PD3: Han conseguido meter todos los cacharritos en uno. ¡Increíble! El paso de 1993 hasta 2013: veinte años de avances:

PD4: ¿Se repite la historia? Si medimos la evolución del Dow Jones en oro, para evitar la inflación o la devaluación de la divisa…, tenemos:

Sin vincular al oro ya sabes la evolución que han tenido:

PD5: La bajada de las primas de riesgo ha sido general en todos los PIGS, no pienses que ha sido sólo cosa de Rajoy que ha conseguido algo bueno para España… No, en todos los países europeos ha habido en este año una mejoría significativa de las primas de riesgo… Hasta los países quebrados que todos sabemos que nunca van a devolver o repagar los papelitos que tienen emitidos. Mira que cacho rally llevan los bonos griegos en este último año:

Como sabes, los bonos cotizan a un precio que implica una rentabilidad. Pues los bonos griegos han pasado de cotizar un 10% de su nominal a cotizar un 60% de su nominal… Gran ganancia para el que se atreviera a comprarlos hace un año… ¿Ha mejorado Grecia? No, está completamente quebrada y nunca va a pagar estos bonos… Y entonces ¿por qué suben de precio? Se lo deberíamos preguntar a los tesoreros de los bancos grandes franceses y alemanes, ellos tienen la respuesta…: Salvan a los PIGS, reducen sus primas de riesgo, para salvarse ellos mismos… ¿De verdad se van a salvar? Lo dudo, a pesar de las apariencias de este año.

PD6: Razonamiento de un ateo: Son más felices los creyentes…

No creo que sea cuestión de que Dios exista o no. La cuestión es si tienes fe o no. Y lo que sí sabemos por los estudios de economía de la felicidad es que la gente religiosa es más feliz. Sobre todo la gente mayor. A medida que te haces mayor piensas más en la muerte. Y uno de los mayores misterios que queda sin resolver es la muerte. Ahora mismo conocemos casi todo lo que ocurrió desde el Big Bang, hace 14.000 millones de años, hasta el hombre actual. Digo casi porque hay dos cosas que seguimos sin entender. Primero, quién puso ese punto inicial que provocó el Big Bang. Una vez tenemos ese punto y este explota, lo podemos explicar todo con la física, la química, la biología y la evolución darwinista. Pero el origen del punto inicial sigue siendo un misterio. La segunda cosa que no entendemos es cómo aparece la vida hace millones de años. Una vez tenemos el ADN sabemos cómo se llega hasta el hombre. Entendemos perfectamente la evolución. Pero, ¿cómo pasamos a un ADN de la vida, qué es lo que hace el click, cómo se crea la vida? Eso no lo sabemos. Y esas dos cosas tienen que ver con la muerte. No sabemos de dónde viene la vida y no sabemos qué pasa cuando se acaba. Y quizá porque la religión da una explicación a esto, y porque no tenemos una explicación científica, la religión es lo que te consuela. Yo estoy convencido de que te mueres y no pasa nada. Desapareces. Como cuando te desmayas. Y ya está. No apareces vestido de blanco en un sitio muy bien iluminado. Se apaga la luz y ya está. Pero es una cuestión de fe. No puedo demostrarlo ni racionalizarlo ni justificarlo. Lo que si sé es que cuando se mide la felicidad de la gente, los que creen son más felices. Así que si la pregunta fuese qué prefiero, si tener o no tener fe, escogería tener fe. Porque sería más feliz.