Tiene pinta que sí…, exuberancia irracional de nuevo!!!

Feeding the Monster

In Greek mythology there was a monster called Cerberus, the hound of Hades, a monstrous multi-headed dog who guarded the gates of the underworld, preventing the dead from leaving. Today central banks have taken on the role of feeding our own modern version of Cerberus to keep all the troubles away. Ever since the 2008/2009 financial crisis Cerberus has been chained to a wall, but he’s pulling and he’s growling and he’s demanding ever more attention. But in the process of feeding Cerberus with ever lower rates and stimulus central banks keep making him stronger and fiercer and ever more aggressive. But worse, central bankers are running out of food to feed the monster.

This hound of Hades has 3 heads that are named debt, deflation and demographics. Together they make a deadly combination that will result in a massive reset of asset prices. And today I will aim to outline why this will eventually happen.

Most of the town folk have pretended for a long time that Cerberus is contained or denied his existence even as he has grown and is getting stronger. In fact a curious process of denial has begun.

Consider this dramatic shift in narrative:

In 2015 Wall Street analysts had projected the S&P 500 to end the year in the 2,200-2,300 range. Some of the key arguments centered around a narrative that earnings would expand further, that lower oil prices would be good for the consumer (which will spur spending) and that the FOMC would hike rates which would be a positive development as it would show confidence in the recovery and help bank earnings. In short everything was bullish.

None of these narratives came to fruition. GAAP earnings actually started to decline, the fall in oil prices became a disaster as energy stocks started walking on the bring of default and lower oil prices did not translate into increased consumer spending. Finally, after much handwringing and dozens and dozens of Fed speeches, the FOMC finally implemented its first rate hike in 9 years in December of 2015. The immediate result: Bank stocks fell 24%, global markets were in disarray as energy stocks crashed prompting the only response possible: Feed the monster again. China offered stimulus, the BOJ went rate negative, the ECB added QE and cut rates further into negative and the US FOMC took back its offered roadmap of 4 rate hikes for 2016 back to 2 and then, with a highly dovish speech by Janet Yellen, to possibly zero.

In short central banks have simply following the feeding pattern they have followed for years whenever Ceberus get hungry:

Yet suddenly in 2016 the narrative has shifted and the irony has not been lost on people as evidenced by the response to this tweet:

This is called playing tennis without the net especially considering we wouldn’t even have this conversation were it not for constant central bank intervention and jaw boning.

Look, humans are great at rationalizing anything. But there are fundamental truths that are very hard to escape from.

One truth is that GAAP earnings have been declining while pro-forma reporting has been able to mask this decline:

One truth is that GAAP earnings have been declining while pro-forma reporting has been able to mask this decline:

And the recent rally has made the market the most expensive in years in light of this substantial decrease in GAAP earnings:

Which brings us back to Cerberus and his 3 heads of debt, deflation and demographics.

A little history first. Ever since the 1980s we have been in a trend of lower highs in GDP growth:

On any sign of trouble central banks have done their part to help: Cut rates. But in doing so their efforts to reflate rates after each downturn has resulted in lower highs and culminated in, well, rock bottom:

The conclusion: Feeding the monster has diminishing returns and this in spite of feeding the monster ever more.

Consider that these rate declines enabled the ever increasing cycle of debt:

Not only in absolute terms, but also as part of the economy at large:

And of course it’s a global issue and has only increased since the publication of this study last year:

The immediate conclusion: Not only is GDP growth shrinking, it is also vastly overstated as it is augmented by deficit spending:

What central banks have been able to do is permit for all this debt growth to be virtually consequence free. Due to zero rates all debt can be financed at very low rates and so despite massive increases in debt the amount of money needed to pay interest on debt has actually been relatively stable at around $400-450B per year:

The problem should be obvious: If the FOMC were to normalize rates to say, 3-4%, the incremental increase in interest payments would render the US discretionary budget insolvent as each 1% increase would ultimately cause a $200B increase in payments required. So the notion of rate normalization appears to be entirely unrealistic. Additionally there is zero evidence to suggest that the US government can run deficit free. So it’s a perpetual cycle of ever more debt that requires ever more resources to service it.

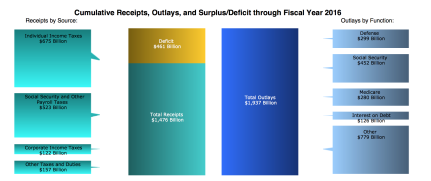

Even with the most tax receipts ever the US government is running a massive deficit as shown herefor the first 6 months of fiscal 2016:

Government debt is not the only issue. Consumers have been loading up on debt for years:

All of this also sustainable only due to low rates. In other words: Rate hikes would eventually severely disturb this seemingly serene picture.

Corporations have been joining the party and taking on ever more debt:

and the combination of it all shows a massive disconnect from the underlying productive asset base:

The conclusion: Low rates have enabled an unprecedented increase in debt for governments, consumers and businesses.

What has it all produced? What are the results? And how do they pertain to sustainability?

If one takes on debt to expand, to produce more, to become more productive, to earn higher rates of return, then debt makes sense as it ultimately gets paid off. But none of these goals are being achieved:

Real household incomes have been decreasing:

Retail sales are not increasing:

And how could they? While debt service payments have remained stable, due to low rates, many key budget items for families have gone nowhere but up:

Rents:

Medical:

And we already mentioned student loans:

Combine some of these things and you get:

But remember the Fed says there is no inflation. Worse for consumer: The dollars they do earn have ultimately less and less value as purchasing power keeps dwindling:

None of this is sustainable or will result in growth without large increases in wage growth and productivity.

The evidence? Severely lacking.

It’s a symptom of larger issues. Folks are stretched and don’t have the income or wage growth to sustain their financial obligations.

The structural reality shows lower highs for wage growth:

Productivity is not increasing:

In fact in this latest recovery, despite the unprecedented increases in debt, productivity is lagging severely:

And it’s a global issue:

Has debt produced investment? The answer is no:

But it’s producing low rates enabled buybacks of stocks:

So the picture that presents itself is this:

Despite the taking on of record debt with ever more stimulus the returns on investment are decreasing.

The culprit: Structural deflationary forces, the biggest one of which is technology itself. One symptom is the massive value Wall Street places on the very companies that benefit the most from technology: The FANGs of the world. Facebook, Amazon, Netflix, Google and many others that are able to build global monopolies on scalable platforms that require relatively few people. None of these companies produce any real products, but they can reach literally billions of eyeballs with a limited number of employees. Highly effective, highly concentrated, but highly limited for employment expansion. One could even go as far as to say that some of these companies are in essence sapping productivity from the rest of society. All consumer activities associated with them could be counted as nonproductive.

After all who is productive browsing Facebook, YouTube, Google, etc?

The answer preciously few.

Speaking of few: The ones actually employed. The Fed tells us we are close to full employment. Yet the number of people not in the labor force has shown one long standing trend:

As of late there has been a little dip and it is called a major improvement and change in trend.

Perhaps, but it is again the prospect of enhanced technology that suggests further deflationary trends to come, especially for many job categories that may face complete extinction. The driver? AI and robotics. We see incredible developments in driverless cars, chat bots, actual robots capable of taking on basic human tasks. While none of these technologies are ready for mass implementation, one can firmly sense that they are around the corner in the years ahead. The potential victims? The trucking industries, customer care services, warehouse operations, etc. In short: Millions of jobs may disappear and be replaced by what exactly?

Speaking of human replacement: Demographics.

The coming shift in demographics is dramatic:

And the Fed knows is. The Atlanta Fed after all has this header image on their twitter feed:

They know. And it’s a huge problem as the size of unfunded liabilities is exploding further with each day:

Look we can all pretend Cerberus is not there and he won’t come to bite us or let the evils out of Hades. But the math simply doesn’t work.

Central banks can’t change the business cycle. Their game is one of pretend confidence and feeding the monster as best as they can. But they don’t produce jobs, they don’t produce growth, heck they can’t even predict anything:

Here’s the Atlanta Fed in February:

And here they are in April:

Alan Greenspan summarized it best:

And so the warning signs are mounting:

And I’m not alone in seeing massive risk building as a result of all these central bank actions.

“These actions are severely punishing the world’s savers and creating incentives to reach for yield, pushing investors into less liquid asset classes and increased levels of risk, with potentially dangerous financial and economic consequences,” Fink said. That and other forces, including geopolitical instability, are creating “a level of fragility in the global economy that we have not seen since the lead-up to the financial crisis.”

But it’s not only financial risk that is of concern, there is the political risk that appears not priced into markets at all. In June the UK faces a Brexit vote largely driven by discontent over imposing European policies.

Even Germany is feeling the heat and a stretching of its political spectrum.

Politicians from Chancellor Angela Merkel conservative camp, to which the finance minister belongs, have complained the ECB’s ultra-low rates are creating a “gaping hole” in savers’ finances and pensioners’ retirement plans as returns have dropped.

Schaeuble suggested they risked fuelling the rise of euroscepticism in Germany, where voters flocked to the right-wing Alternative for Germany in state elections last month.

“It is undisputable that the policy of low interest rates is causing extraordinary problems for the banks and the whole financial sector in Germany,” said the 73-year-old. “That also applies for retirement provisions.”

“That is why I always point out that this does not necessarily strengthen citizens’ readiness to trust in European integration,” he added in an interview.

Markets are currently ignoring all of it.

What does this all mean for stocks for the here and now?

On a GAAP basis earnings are back to where they were at the peak of the 2007 earnings cycle:

Structurally the S&P 500 has been following a familiar pattern: It rises on increased earnings, it breaks trend once earnings stall, has a correction and bounces back to reconnect with major moving averages before falling further. Markets have just bounced back and strongly so primarily driven by short covering and massive central bank intervention and jaw boning. But now we find ourselves at a key juncture: Repeat the pattern or diverge from it. My supposition has been that without a sudden positive turn in earnings this rally will be hard to sustain:

So the question that presents itself is not one of destination. The destination is clear. It’s a massive re-alignment of asset prices down the road. It’s widely acknowledged that most asset prices are vastly overvalued. Here’s VC Peter Thiel:

“Startup tech stocks may be overvalued, but so are public equities, so are houses, so are government bonds”

While Janet Yellen denies the existence of bubbles she is amongst the chief architects of fueling overvaluation of asset prices globally.

The math shows clearly that the FOMC can’t really raise rates in any substantial manner at all. So it’s an elaborate PR dance that is on display on a monthly basis with dozens of Fed speeches full of sound and fury signifying nothing.

The real question then is one of the exact path to perdition. The charts above indicate that markets are at a key juncture. Either they will break lower this summer or, if central banks succeed one more time, can create the one element this bull market has been lacking: A proper blow-off top.

Just know a blow-off top will make markets not cheaper, but much more expensive:

In either case: Cerberus will continue to demand to be fed. And the math says he is getting hungrier every day. And looking around the world it appears he wants a change in diet as more and more stimulus is not only producing diminishing return, but is breeding more political discontent.

What this means for me from a trading perspective is simply this: I want to observe this earnings season for clarity. Without a sudden positive shift in earnings prospects this market remains at very high risk of following the previous historic structures, hence I remain defensive/tactical here. Should earnings improve subtantially then basic fib retraces of this rally may be buyable. If not, then Cerberus will break his leash sooner rather than later.

Abrazos,

PD1: Hay gente que dice que ese o aquél están perdidos y no hay forma de poder acercarle a Dios, que es un vaina, o que no quiere saber nada, que ha perdido completamente su fe… Pues debemos tratar a todos y debemos rezar por todos, hasta por el más complicadito de nuestro entorno. Dios nos va poniendo cerca nuestro a mucha gente. Si nos pusiera siempre a los mejores, a los más listos y a los más creyentes, no tendríamos mucho trabajo. Pero no, hay que ir a por todos, hasta por el imposible. Hay que perseverar y no tirar nunca la toalla. Sabernos instrumentos y no pensar que podemos con nuestras fuerzas, eso sí que sería imposible. Y sobre todo, rezar por los más difíciles…